Author: Ali, former technical director of Gridex; Translator: Jinse Caijing xiaozou

1, Preface

Last August, Friend.tech's points system was launched, and now points have become the industry standard for off-chain rewards (or tokens, XP and other similar rewards) to reward early users of the protocol. It can be said that this is the beginning of the airdrop craze in this cycle, and a series of projects have released tokens in the past year. Like many crypto crazes, the airdrop "gold rush" in people's eyes will eventually be like a bubble, beautiful but ephemeral.

Is the airdrop craze over? Or is it just a short halftime break?

2Performance of 47 Airdrop Tokens

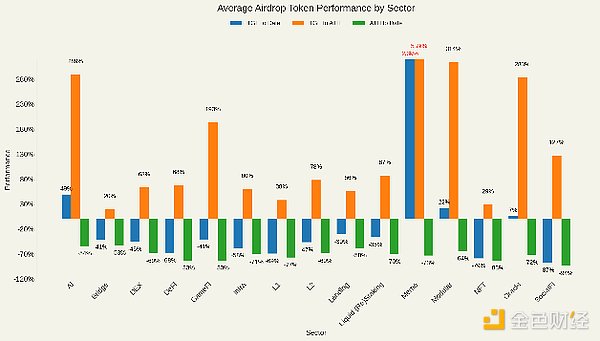

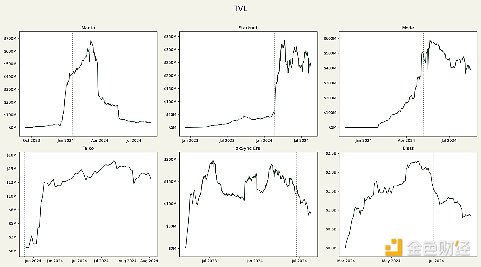

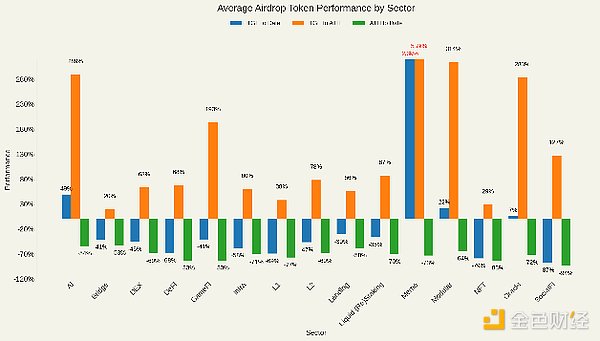

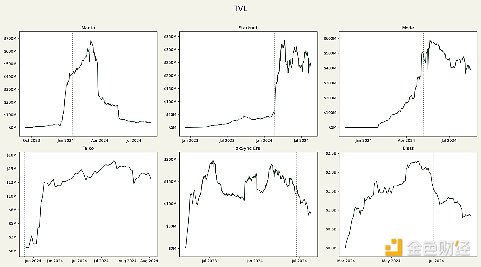

Airdrop tokens are notorious for their “down-and-out” price action. As of August 25, 2024, of the 47 airdrops I consider to be the most hyped, only 11 of them were priced above the TGE (token generation event), with an average return of 49.56% (excluding BONK). Meanwhile, the 36 airdrops that were priced below the TGE had an average decline of 62.15%. Now, some tokens did see some price gains, with an average gain of 162.23% from TGE to ATH (excluding BONK). However, among these tokens, the average retracement after the ATH was 70.89%. While a downward correction from the ATH is also a normal market condition, it is worrying that many of these tokens have shown such a large decline in a matter of months.

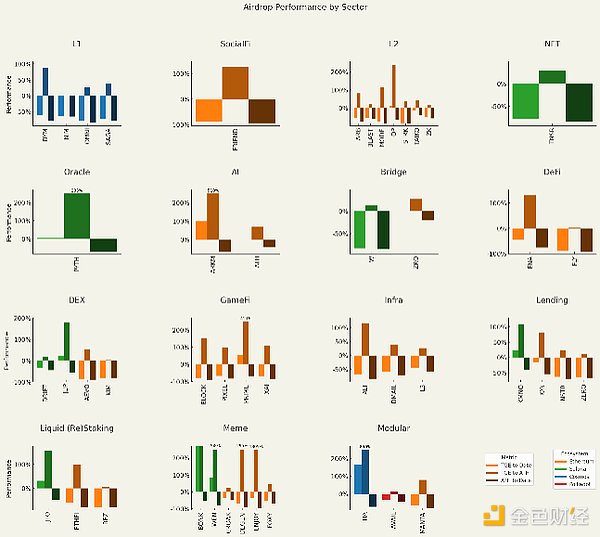

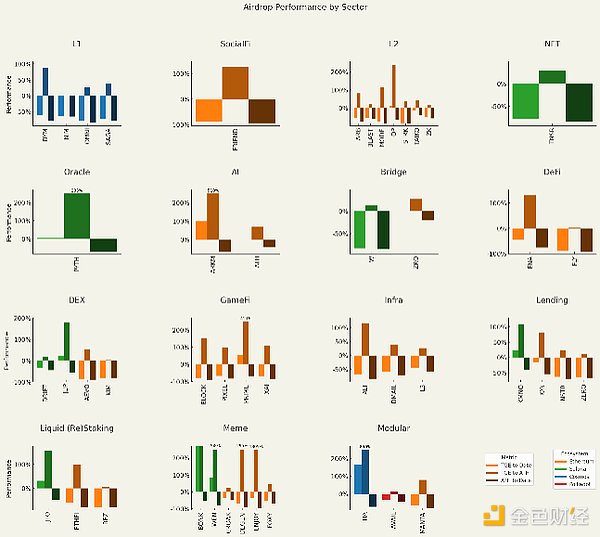

The trend is clear, with the exception of certain sectors that have been popular so far in this cycle (meme and AI), the trend of airdrop tokens has basically been in free fall since 2023 (of course there are also some airdrops in between).

On average, only AI, meme and modular airdrops have actually risen after the TGE, while other airdrops have fallen sharply. So far, meme is the strongest performing sector, with an average increase of 2300% since 2016, with BONK having the largest increase. In fact, in my opinion, it was BONK that saved Solana (Soylana two years ago) from the depths of despair after FTX.

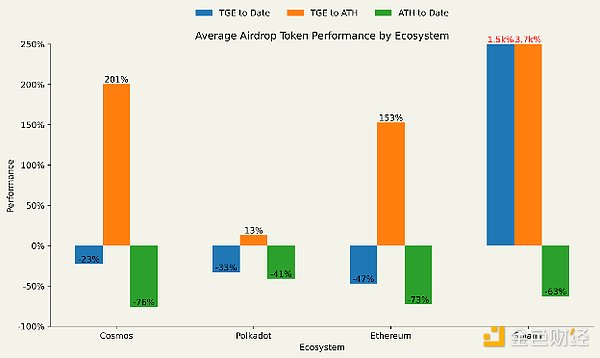

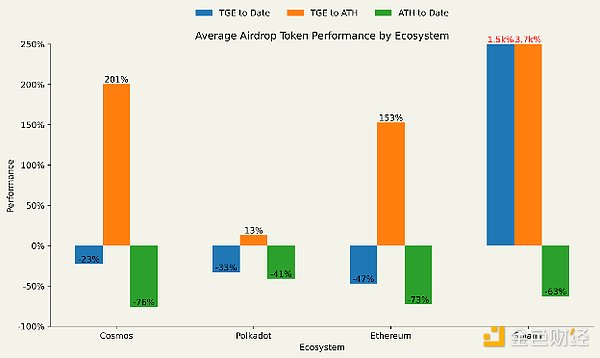

When sorting the average return of airdrops by ecosystem, only Solana’s airdropped token has been priced above TGE levels so far, and again the main force is BONK. Ethereum-based airdrops are the worst performers, while Cosmos-based airdrops have the most intense price action. With an average ATH of 201% compared to TGE, coupled with TIA’s 850% increase, Cosmos-based airdrops are all the rage in Q4 2023. The Cosmos airdrop started a short-lived phenomenon of staking airdrops to earn more airdrops, which quickly faded, and with the exception of DYM (down 61.1% from TGE), there have been no notable airdrops since TIA.

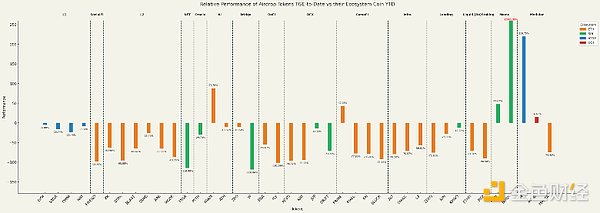

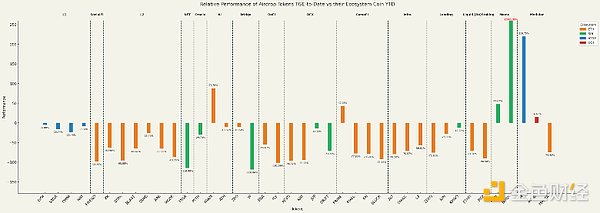

One could argue that the performance to date and the drop after the ATH is because of the general performance of the altcoin market and not because of the airdrops, however, when comparing the performance of the airdropped tokens since TGE to the YTD performance of their underlying ecosystem tokens, only 6 tokens out of 47 (half of which are meme or AI sectors) have outperformed their ecosystem tokens.

Relative performance of airdropped tokens TGE to date relative to their ecosystem tokens. Truncated outliers are highlighted in red. Source: CoinMarketCap and CoinGecko as of August 25, 2024.

Crypto Twitter attributes this epidemic symptom to the low circulation, high FDV token economics - complaining that these tokens are merely VC dumping vehicles and are therefore almost designed to only go down and not up. While this view has some weight, especially considering that the utility of most tokens depends on governance rights, the value of which is murky, there seems to be a deeper and more worrying problem. Projects that rely on usage, whether measured by TVL, trading volume, or other metrics, paint a troubling post-TGE picture.

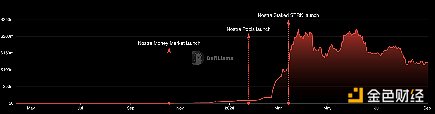

3、L2

The TVL growth of the much-hyped emerging L2s is not impressive, and some even show a pure downward trajectory. Blast and zkSync Era are two of the most obvious examples - both airdrops that were heavily scalped by scalping studios seem to have lost steam post-TGE. Manta Pacific initially continued to show strength post-TGE, but this can be attributed to their “New Paradigm” event, which only supported outbound bridges from Manta Pacific until March 26, 2024, after which the chain’s TVL fell sharply and is currently 94% down from its ATH. A similar story may be happening with Mode, which held back 50% of its token allocation from the first 2,000 wallets for 3 months, unlocking on the condition that they would not outbound bridge during this period. Beyond that, Mode’s relative strength may be attributed to its Season 2 points program, which Manta does not have (although they did hold a “Restaking Paradigm” event), as well as Mode’s inclusion in Optimism’s Superfest event. Taiko chose to conduct a TGE at the time of its mainnet launch, which had a positive impact on TVL, but at only $14 million - 0.73% of its token’s TVL - it is clear that there is little attention in this space.

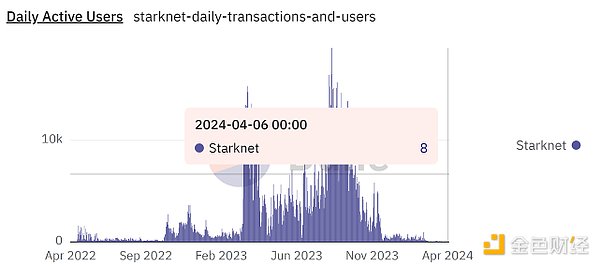

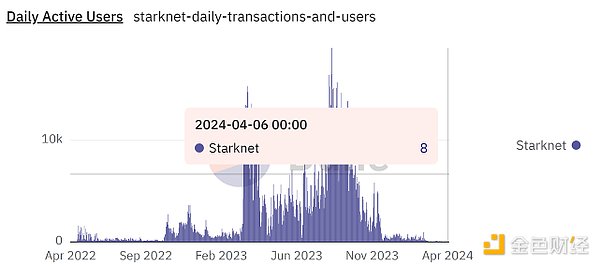

Starknet’s TVL did not follow this trend, and instead visibly surged after the TGE. While this performance is undoubtedly surprising, it is also so out of touch with market sentiment that one can’t help but wonder.

Can the last 8 users on Starknet really bring it back to full strength? Before the Starknet worshippers crucify me, let me say that Dune’s data is inaccurate; the DAU on June 4th was actually 212,000, down 94% from the ATH two months ago. The first thing to note is that Starknet successfully raised $282.5 million at a valuation of $8 billion, which means that the TVL is still 18% less than the funds raised. In contrast, Blast only raised $20 million, and its TVL is 190% higher than the amount raised, which is not surprising. It is also important to note that Nostra and Ekubo (both of which had disappointing airdrop performance) account for 85% of Starknet TVL.

While it is unclear what exactly is driving Starknet TVL, one view is bullish on Nostra, with NSTR currently having a fully diluted market cap of $6.3 million and a FDV/TVL ratio of 5%.

4, Bridge

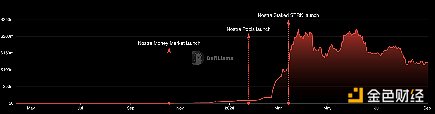

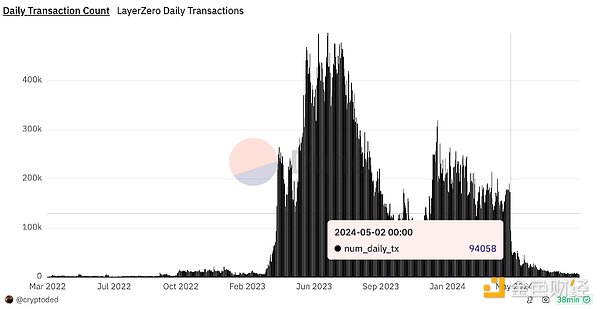

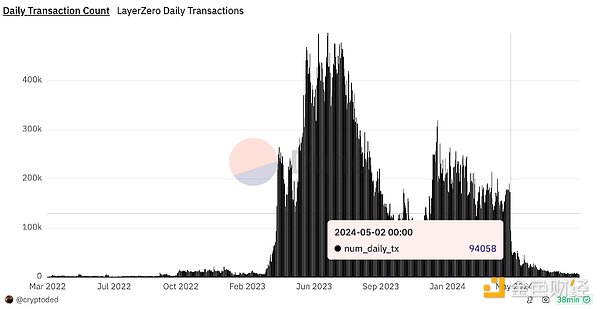

Let's take a look at LayerZero's daily transaction volume, and everything will be clearer.

After the first snapshot of the ZRO airdrop was announced on January 5, 2024, the number of daily transactions plummeted 52% to around 45k, and is currently 92% below the level on January 5, 2024, at less than 7000. To date, farmers, sybils - whatever you want to call them - have been the driving force of crypto adoption, or at least it seems so. While LayerZero is "old school" in that it does not have a points program, it always sends tokens and users act accordingly to drive as many transactions as possible to maximize their airdrops. These transaction volumes should be the exaggerated metrics thrown to VCs when LayerZero raises $120 million in Series B funding in April 2023. Comparing this performance to the airdrops prior to August 2023 (arguably from the previous cycle) shows a very different picture (of course, we are talking about the performance of the projects here, not the performance of their tokens). With the exception of Aptos, which had to launch a TGE at mainnet launch (because APT is a gas payment token), Optimism and Arbitrum launched governance tokens more than a year after their mainnet launches, after they had already established a good foundation. This is in stark contrast to the more speculative market environment shown in this cycle, where projects will fast-track their mainnets and TGEs in the hope of profiting. The L2 space is still in its infancy at this point - a far cry from the L2 feel of this cycle. 5. Where do airdrops go? Looking at the largest airdrops of all time (ranked by ATH), at least 7 of them were an unexpected surprise to those who received them, and this positive sentiment likely led to the token's price rebound shortly after the TGE. Last cycle, most airdrops were popular because they were seen as free money. Yes, airdrop farming for profit became more popular at the end of the cycle, but it is still far from the mindshare of this cycle. While Friendtech's points system was exciting at first, after a few months, every project was waiting for the bear market to end so that they could release a TGE to create their own points program, making innovation a cliché.

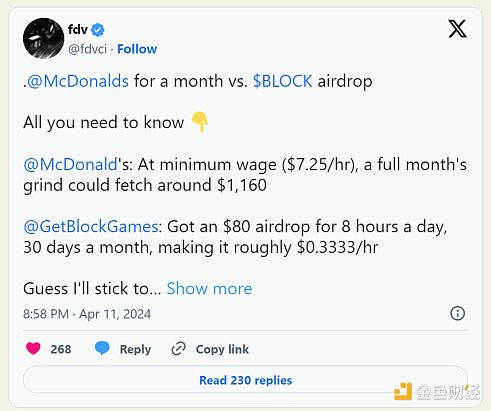

Season after season of points farming requires more and more time and money, which has diminished the luster of airdrops. Now, airdrops are no longer "free money", people have to pay for them. People are becoming more and more aware of the return on airdrops, considering factors such as time, liquidity and fees, and recently almost all airdrops have been caught in a post-TGE death spiral.

It's time for the points craze to subside. If projects regress to indiscriminately squeezing farmers' value through points and leaderboards, and the overall market turns bullish, farmers may suffer again.

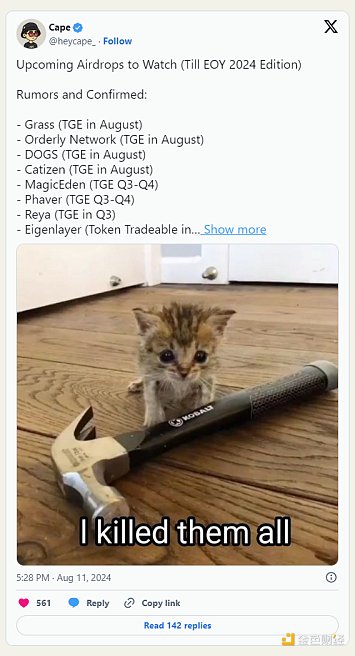

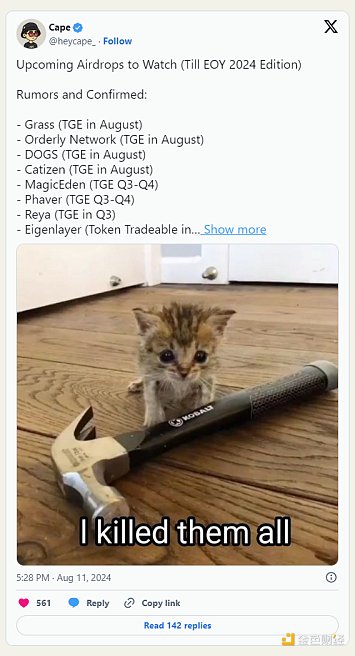

6What other airdrops are worth paying attention to? Are they worth it?

There are always no less than dozens of projects in the TGE track, and we will only discuss a few here.

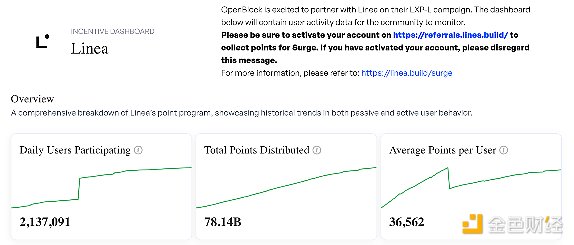

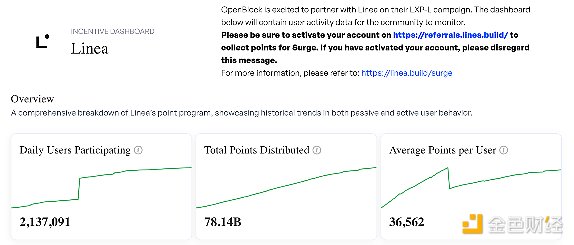

(1)LineaandScroll

Linea and Scroll are the last two large L2s without tokens (assuming Base does not issue tokens), of which Scroll's financing amount is US$80 million and its valuation is US$1.8 billion, while Linea's parent company Consensys has a total financing amount of US$725 million and a valuation of US$7 billion. Although Consensys has many other projects, such as MetaMask, it is certain that Linea has strong financial support. Compared to zkSync and Starknet, which raised $458M and $282.5M at $8B valuations respectively, Linea is at least a potential stock, depending on overall market enthusiasm. While STRK briefly peaked at $50B in FDV minutes after launch — more than 6x its valuation — ZK launched with around $4.7B in FDV, and these are very solid airdrops for zkSync farmers and developers who happened to submit a project at the Starknet hackathon. While zkSync’s FDV release before March 2024 will be considered FUD, most dedicated farmers still reaped at least a few thousand dollars worth of ZK. For this reason, I think yield farming Linea pre-surge and Scroll pre-marks farmers can look forward to an early Christmas gift in Q4. If you are a latecomer, it will take a lot of financial support to catch up with others, but if you are farming multiple protocols at the same time (for example, providing WRSETH/ETH liquidity on Ambient to yield farming Kelp, Scroll, and Ambient), such an investment may be worth it.

Linea:

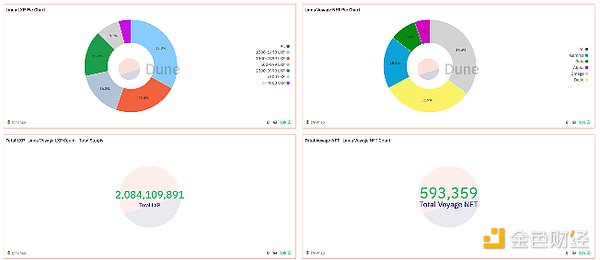

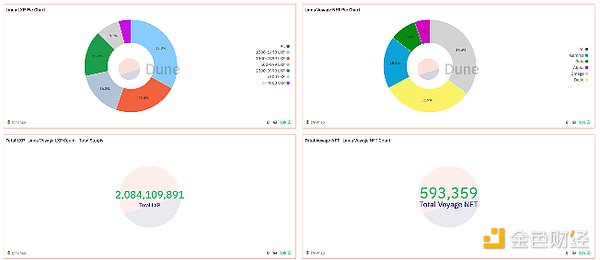

According to WhalesMarket, LXP and LXP-L are currently valued at $0.11 and $0.003 respectively, which means that the general airdrop associated with LXP-L is only $109, while the total airdrop of LXP-L exceeds $234 million.

According to a Dune data, most users have 1,000 to 1,499 LXP, which means only $137 in pre-market value for most users - very little for a few months of friction and clicks. There is also the Linea Voyage testnet NFT, whose

Delta version is currently selling for 0.00187 ETH (about $5) on Element.

If the pre-listing situation is to be believed, the average Linea farmer can only expect to receive $251, which is probably around $150 after deducting gas fees. I personally think that the pre-listing situation is overly bearish due to the trauma of the L2 airdrop, and if the overall market sentiment turns bullish and CT's attitude towards airdrops returns to the direction before March, then LXP should be worth at least $0.50. Despite this, I still think that most people will be disappointed with Linea because as the project focuses more and more on TVL, it is no longer as profitable to drive transactions as before.

Doing the same calculation for the user who received the most available LXP, and has already earned over $20,000 from the first Surge points program, we know:

● Alpha NFT = 0.05991 ETH (~$151)

● Top 4.3% of LXP holders = 4000 LXP (~$440)

● Top 1500 LXP-L holders = 3.5 million LXP-L (~$10,500)

● $11,091 in total

I expect Q4 testnet NFTs and LXP to be more valuable at the TGE, and I also expect some traceable LXP to be distributed in general activities before the TGE. Regardless, this is already a very good airdrop for Surge, with an APY of 25% for providing liquidity.

Scroll:

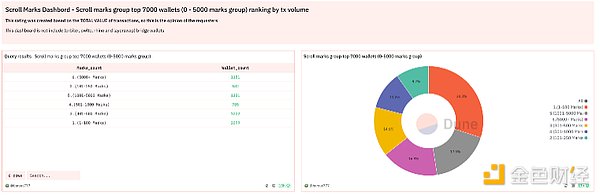

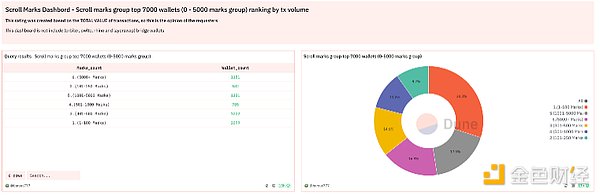

The data for Scroll is more direct. In the WhalesMarket market (with very low trading volume), Scroll marks are currently worth about $0.27, and most wallets holding 0-100 marks are worth $27, but this is only the first phase, so we can expect this number to rise. The number of wallets holding more than 5000 marks is considerable, accounting for 16.9%, with a return of more than $1350.

In addition, Scroll Canvas requires users to collect more NFT badges through traditional trading methods. While the project no longer provides large token allocations for trading-based activities, I find it hard to believe that badges have nothing to do with airdrop allocations. Considering that badges are separate from the points program, they may act as a multiplier for points.

Overall, unless you are doing yield farming before the release of marks, I think there are better places to put your funds. That being said, if Crypto Twitter's attitude towards airdrops returns to pre-March, then airdrop mining may be worth it.

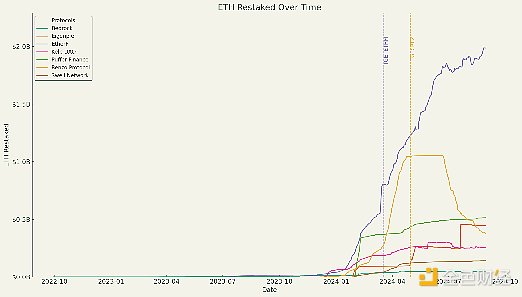

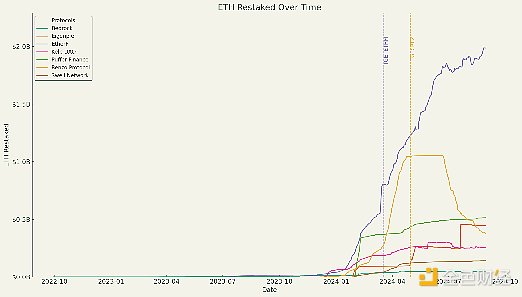

(2)LRT(Liquidity Re-staking Token)

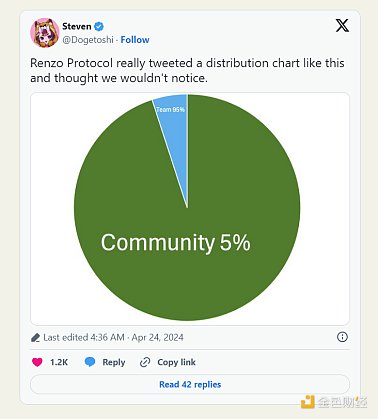

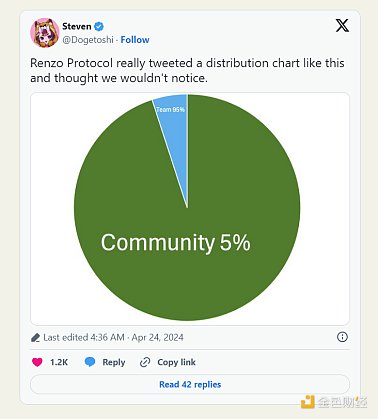

Of the top 7 ETH liquidity re-staking protocols, only 2 have airdropped so far: EtherFi and Renzo. While their tokens have performed mediocrely, falling 60.4% and 79.7% from the TGE respectively, EtherFi has shown considerable strength and solidified itself as the must-have LRT. Meanwhile, Renzo’s TVL stagnated after the TGE, only to begin its dramatic decline a few months later. This is likely due to the withdrawal feature not being available until June, meaning many farmers were left holding onto their ezETH wallets while ezETH decoupled on the open market. So it's no surprise that there has been no new ETH inflows after the TGE after their "chart crime" on Twitter.

Other major LRTs haven't shown strong growth since the airdrop craze died down, so I doubt there's room for yield, even though I'm farming Linea and Scroll while farming Kelp.

We're still waiting for the EIGEN TGE, but at a pre-list price of $3.62, most farmers won't invest more than $400, even if they can get an extra 100 EIGEN. We can see Karak and Symbiotic get ahead of EIGEN at the TGE, but these yield farming operations are capital intensive.

(3)BerachainandMonad

Finally we have two of the most mysterious and hyped projects we have seen: Berachain and Monad. While there has been a lot of interest in both over the past 6 months, it is unclear how the airdrops will be conducted and there is no clear mainnet launch date. Considering they raised $142 million at valuations of $420.69 million and $244 million respectively, this is undoubtedly a good thing for those who received their token allocation.

We start with Berachain, the less mysterious of the two, and collecting countless (expensive) Bera NFTs and obtaining exclusive Discord characters may be the most rewarding. If you are not interested in trading NFTs, then your best bet is to regularly interact with all the major dapps on the testnet (BEX, BEND, BERPS, etc.). A good way to do this is to collect badges through TheHoneyJar's quests, although they are not directly associated with Berachain. That said, testnet interactions may not mean anything (never forget Sui).

Monad is essentially a cult, at least for now, and the only way to farm yield is to gain reputation in their socials, as there is no testnet.

7Conclusion

Yes, the airdrop craze is dead, but it will be resurrected one day.

JinseFinance

JinseFinance