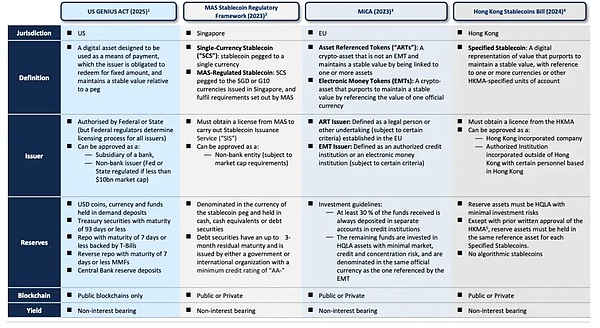

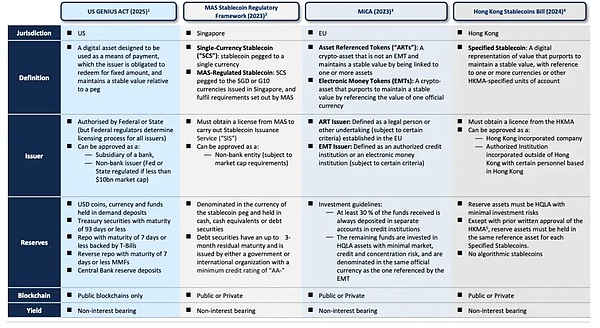

As the US rules system is established, similar frameworks are emerging in many places around the world (such as Hong Kong's "Stablecoin Ordinance"), and more stablecoin regulations are expected to be introduced one after another.

▲ TBAC Presentation, Digital Money

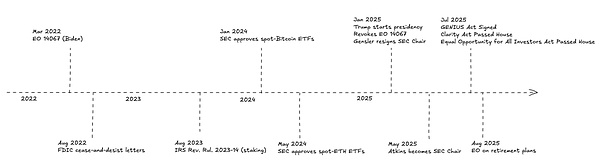

Other Policy Trends

New Retirement Plan Investment Policy

The Executive Order on Expanding Access to Alternative Assets for 401(k) Investors, signed in August 2025, aims to expand the investment options for employer-sponsored retirement plans and allow retirement savers to allocate alternative assets such as digital assets through actively managed investment tools. As an executive branch, the Department of Labor is required to reevaluate its Employee Retirement Income Security Act (ERISA) guidance within six months. It is expected to introduce ERISA-compliant safeguards: reaffirming the neutral, case-by-case prudential standard and providing a safe harbor checklist. While the independent SEC is not directly subject to the executive order, it can facilitate access through rulemaking: clarifying qualified custodian standards, improving disclosure and marketing regulations for crypto funds, and approving retirement plan-friendly investment vehicles. Currently, most 401(k) plans still exclude crypto assets from their core menus. Instead, access is primarily through self-directed brokerage windows, where participants can purchase spot Bitcoin ETFs (some plans also include Ethereum ETFs), and a few providers offer limited "crypto asset windows." In the short term, compliance paths will be limited to regulated ERISA-compliant products: spot BTC/ETH ETFs and professionally managed funds with structured crypto allocations. Because 401(k) committees adhere to ERISA's "prudent investor" principle, it's difficult to demonstrate that single volatility tokens, self-custody, or staking/DeFi yields are suitable for average savers. Most tokens and yield strategies lack standardized net asset value accounting, stable liquidity, and a clear custodial audit trail. Their legal status is unclear, and inclusion in plans could trigger SEC/DOL scrutiny and the risk of class action lawsuits. The Equal Opportunity for All Investors Act proposes a new "accredited investor" designation path by establishing an SEC knowledge test. The House of Representatives passed the bill on July 21, 2025, and the Senate accepted it for consideration on July 22. Early-stage token pre-sales, crypto venture capital, and most private rounds in the United States are governed by Regulation D, which currently restricts participation to accredited investors. This knowledge-based exam path will overcome wealth/income thresholds, allowing investors with specialized knowledge but not necessarily wealthy to legally participate in private crypto financing. Opponents argue that expanding access to the opaque and illiquid private market could increase investment risks. The bill's fate in the Senate will depend on the rigor of the exam and the adequacy of its safeguards. Even if passed, the SEC would need one year to design the exam and 180 days for implementation through FINRA, meaning it would not take effect immediately. The BITCOIN Act (S.954), introduced by Senator Cynthia Lummis on March 11, 2025, proposes to establish a U.S. strategic Bitcoin reserve. The bill requires the Treasury to purchase 200,000 BTC annually for five years, with a total of one million, and imposes a 20-year lock-up period during which sales, swaps, or pledges are prohibited. After 20 years, gradual sales (limited to 10% of holdings every two years) may only be proposed to reduce federal debt. The bill also stipulates that confiscated BTC must be transferred to the strategic reserve after the judicial process is concluded.

The funds will not rely on new taxes or government bonds, but will be raised through: (1) the first $6 billion of the Federal Reserve's annual remittances to the Treasury between fiscal years 2025 and 2029 will be used first to purchase Bitcoin; and (2) the book value of the Federal Reserve's gold certificates will be revalued from $42.22 per ounce to the market price (approximately $3,000 per ounce), with the increased value first injected into the Bitcoin plan. If fully implemented, the US would have purchased a cumulative 1 million BTC (approximately 4.8% of the 21 million BTC cap). By comparison, MicroStrategy, currently the largest publicly traded company holding Bitcoin, holds 629,000 (approximately 3%). This reserve size would surpass any single ETF holding, and even significantly surpass the industry-wide total ETF holdings of approximately 1.63 million, as reported by bitcointreasuries.net. By elevating Bitcoin to strategic reserve asset status, the United States will grant it unprecedented legitimacy. This official endorsement could shift the stance of institutional investors who have been hesitant due to regulatory uncertainty. If the United States takes the lead, other countries could follow suit. All of these effects will create a powerful driver of Bitcoin's price: five years of sustained purchases will create substantial demand, and the supply shock created by a 20-year lock-up period will likely lead to global capital allocation. However, the BITCOIN Act has only been submitted to the Senate Banking Committee and has yet to be reviewed or voted on. Its progress lags far behind the CLARITY Act, which has already passed the House of Representatives, and the already enacted GENIUS Act. On a practical level, the bill touches on core issues concerning Federal Reserve independence and budgetary politics: the mandatory purchase of 1 million BTC, locked up for 20 years, financed through Federal Reserve remittances and gold revaluation. The bill currently enjoys primary Republican support, but major decisions involving balance sheet assets typically require bipartisan consensus for Senate passage. More importantly, directing future Federal Reserve remittances to Bitcoin purchases would reduce fiscal revenue that could be used to reduce borrowing, potentially exacerbating budget deficit risks. The clearest signal of a shift in policy direction was the SEC's approval of spot crypto ETFs after years of delay. In January 2024, the agency made history by approving multiple spot Bitcoin ETPs and immediately launching trading, driving Bitcoin to a record high in March and attracting mainstream capital. By July 2024, spot Ethereum ETFs were trading in the United States, with major issuers launching funds that directly hold ETH. The SEC has also demonstrated an openness to assets beyond Bitcoin and Ethereum: it is actively processing applications for other crypto ETFs and working with exchanges to develop common listing standards to streamline future approvals. Positive progress has also been made in the staking sector—the SEC recently clarified that "agreed staking activities" do not constitute an offering of securities under federal securities laws. Development of Prediction Markets in the United States: In early October 2024, a federal appeals court approved the prediction market platform Kalshi to launch before the election, significantly boosting market participation. The CFTC subsequently continued to advance its rulemaking on event contracts and held a roundtable in 2025. While no timeline has been set, further guidance or final rules are possible. Polymarket, through its subsidiary QCX LLC (now Polymarket US), received CFTC-designated contract market status and announced the acquisition of the QCEX exchange, stating that US access will be available "in the near future." If integration and approvals go smoothly and the CFTC ultimately opens its doors to political contracts, Polymarket may be able to participate in the 2026 US election prediction market. The platform is reportedly exploring issuing its own stablecoin to capture Treasury yields from the platform's reserves, but currently, user returns primarily come from market-making/liquidity rewards rather than real-world asset returns on idle funds. Conclusion: US policy is the primary lever shaping market structure and capital access, and thus has a decisive influence on Bitcoin prices. The SEC's approval of a spot ETF on January 10, 2024, opened up mainstream funding channels and propelled Bitcoin to a record high in March 2024. The friendly policy environment created by Trump's election victory in November 2024 further pushed prices to a new all-time high in July-August 2025. Future trends will depend on the progress of regulatory and infrastructure standardization. Baseline Scenario: Continued policy implementation. Regulators implement the GENIUS Act, the Department of Labor establishes ERISA safeguards, and the SEC gradually approves ETF/staking mechanisms. Access to brokerage windows and registered investment advisors (RIAs) expands, while banks and card schemes expand stablecoin settlement applications. Optimistic Scenario: The Senate advances market structure legislation, the first batch of "mature blockchain" certifications are issued without significant objections, and the Department of Labor provides a safe harbor. Banks issue licensed stablecoins on a large scale, and the ETF product menu continues to expand. This will accelerate allocation by pension funds and RIAs, increase liquidity depth, and lead to a revaluation of compliant, truly decentralized assets. Pessimistic Scenario: Legislative progress stalls—all pending bills remain unaddressed. The SEC delays or rejects applications for amendments to collateralized ETFs. Bank regulators take a hard line on implementation of the GENIUS Act, delaying large-scale issuance; and major record-keepers restrict brokerage window access. Regardless of the scenario, the following hard indicators will serve as key signals: the number of licensed stablecoin issuers and settlement volume, the first batch of mature certifications and SEC objections, net ETF inflows and the percentage of 401(k) plans with brokerage windows, and the progress of bank/card scheme settlement pilots into full-scale operations. These indicators will reveal whether the US crypto market is evolving toward a regulated financial system or relapsing into contraction.

Catherine

Catherine