By Jaran Mellerud, CoinDesk; Translated by Baishui, Golden Finance

Bitcoin’s hashrate won’t drop that much

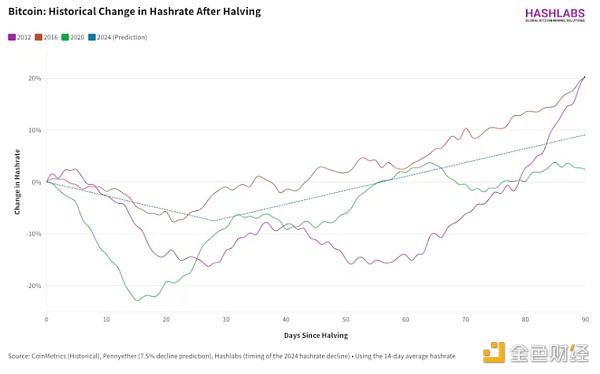

Contrary to popular belief, the halving may not result in a significant drop in the network’s hashrate. After Bitcoin’s first three halvings, hashrate plummeted by 25%, 11%, and 25%, and it appears that many analysts and miners are expecting (or hoping?) for a similar drop this time around.

I agree with Pennyether’s prediction that the upcoming Bitcoin halving is expected to result in a small drop in hashrate, in the range of 5% to 10%. This prediction is also not far off from the 3-7% prediction of the hashrate index.

This cautious prediction stems from the current high profitability of Bitcoin mining, driven by its high price, and the observation that approximately 70% of Bitcoin’s hashrate has been introduced since January 2022, operating under mining economics that are sometimes less favorable than what is now expected post-halving.

In addition, pre-computing power will rebound quickly from this small drop. In the past three halvings, the network recovered its pre-halving computing power level within 57 days on average. This trend highlights an important point: halvings should not be viewed as events that reduce computing power, but rather as brief pauses in the ever-increasing trajectory of computing power.

The robustness of computing power is further enhanced by miners' continuous efforts to update their equipment with the latest and most efficient models. It is expected that this strategy will not only offset short-term declines in computing power, but may also lead to a significant increase in computing power in the coming months.

In essence, the upcoming Bitcoin halving is likely to be just a brief hiccup in the network’s hashrate trajectory rather than a major setback.

High-cost miners will be forced to upgrade equipment

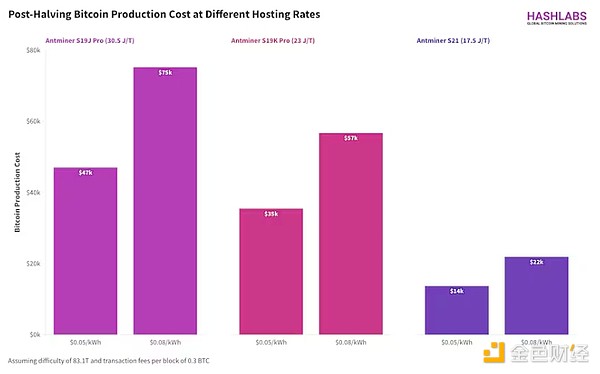

Data from CoinMetrics highlights that most of the industry is currently using relatively inefficient machines, such as the Antminer S19J Pro. These miners will need operating costs of $0.05/kWh or less to maintain healthy gross margins after the halving.

However, according to the Hashrate Index, the average hosting rate in the United States is just under $0.08/kWh, and many U.S. miners may face cash flow challenges after the halving, forcing them to make large-scale equipment upgrades.

Bitmain’s new machines, including the S21, T21, and S21 Pro (each with an efficiency of less than 20 J/TH), were launched just in time for the halving. This development has prompted many US hosting providers to push their customers to switch from the S19J Pro to the S21 model. Given the high hosting costs in the US, this push can be seen as a necessity rather than a choice.

Referring to the above chart, it is clear that the S19J Pro model is unlikely to generate positive cash flow at a price of $0.08 per kWh, given that the direct Bitcoin production cost is $75,000. As a result, miners facing higher operating expenses must turn to more efficient hardware, such as the Antminer S21 or similar models, to maintain profitability.

While upgrading to the latest machines allows operations to continue even in a high-cost environment, it is not a viable long-term strategy. The necessity to constantly update hardware before recouping previous investments often highlights the unsustainability of this approach.

My bottom line message is clear: if you need to use the latest generation of hardware to maintain a positive cash flow, then your operating costs are too high.

Miners will find creative ways to increase profits

Bitcoin mining is one of the freest and most competitive markets in the world, one that Adam Smith himself would have admired. This inherent competitiveness drives a relentless pursuit of innovation, especially during challenging times such as halving events. To cope with the pressure of the halving, miners are employing some of the most creative strategies to maximize the use of existing resources.

One of these strategies is downclocking, a process that reduces the amount of power a machine consumes to improve energy efficiency and reduce costs. This process can be facilitated by third-party firmware such as LuxOS, which significantly improves machine efficiency – a critical adaptation in an environment of thin margins.

In addition, the quest for increased profitability extends beyond operational adjustments to include novel approaches to revenue generation. A notable example is Hashlabs in Finland, where we are working on a project to leverage multiple revenue streams to increase mining profitability.

In Finland, we have diversified our revenue streams to include selling miners’ waste heat to the district heating system, earning fees for contributing to a stable grid, and strategically selling electricity back into the market during periods of high spot prices. These ancillary revenue channels have significantly increased the profitability of our mining operations.

The upcoming halving will act as a catalyst, prompting miners around the world to follow Hashlabs’ lead and explore and implement creative strategies to increase profits.

Some Miners Will Diversify Out of Mining

The fierce competition in the mining industry’s status quo is driving many, especially public miners, to explore new frontiers. There is a growing trend towards AI computing, led by companies like Iren and Hive Digital Technologies.

The diversification trend is expected to accelerate in the challenging months ahead. However, mining dynamics are cyclical. Predictions of a bull run in 2025 foreshadow a reversal of this diversification trend. With the potential climb in Bitcoin’s value, miners may abandon diversification strategies in favor of maximizing mining rewards and reentering the race to extract value from each hash.

This shift between diversification and concentrated mining reflects the broader ebbs and flows of the market. Miners’ strategies evolve as the market changes, balancing the need to seize immediate opportunities in new sectors and prepare for the next upsurge in Bitcoin mining profitability.

Bitcoin mining will become more geographically dispersed

Currently, the United States accounts for a large portion of global hashrate, accounting for 40%, while China and Russia are also major players, contributing 15% and 20% respectively. However, the industry is gradually shifting to a more globally dispersed model, driven by the ongoing pursuit of cost efficiencies, especially cheaper electricity.

As miners prepare for the upcoming halving, many are exploring emerging mining markets in Africa, Latin America, and Asia, where electricity is extremely cheap. For example, Bitfarms has made great progress in Argentina and Paraguay; Bitdeer is expanding its capacity in Bhutan; Marathon is entering the UAE and Paraguay; and Hashlabs offers hosting solutions in Ethiopia.

The upcoming halving event will serve as a catalyst for hashrate migration, forcing miners to venture outside of developed countries to access more economical sources of electricity. This shift toward a more geographically dispersed mining network will have a profound positive impact on Bitcoin. By distributing hashing power more evenly across the globe, Bitcoin mining will not only be less susceptible to regional regulatory risks and fluctuations in electricity costs, but will also be more closely aligned with the decentralized ethos that underpins Bitcoin itself.

Little Impact on Bitcoin Price

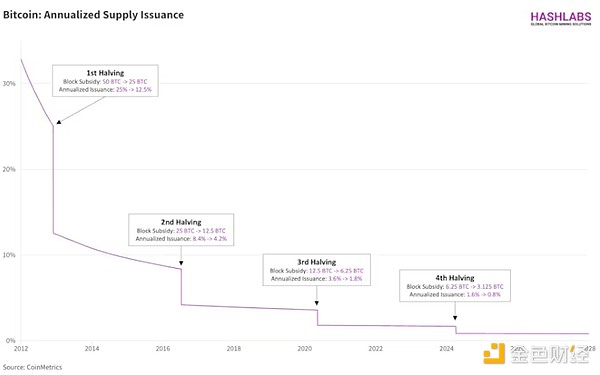

The upcoming Bitcoin halving is seen as a potential trigger for the next bull run. However, given that the current annualized issuance rate is already at a meager 1.6% and nearly 94% of all Bitcoins are already in circulation, the expected supply shock from the halving is likely to have little impact on Bitcoin prices.

The negative supply shocks from earlier halvings were far-reaching, especially during the first halving, when annualized issuance plummeted from 25% to 12.5%, and during the second halving, when annualized issuance dropped from 8.4% to 4.2%. However, the change from 1.6% to 0.8% in the upcoming halving is much smaller than the dramatic changes observed in previous cycles.

Don’t get me wrong; I still expect a bull run after the halving. However, growing demand, not a slight drop in supply, will be the primary factor driving the price surge.

I like Dylan LeClair’s analogy of the halving to “global advertising,” suggesting that its primary impact on Bitcoin’s price is less a direct result of the supply reduction than the increased media attention and investor enthusiasm it generates. This increased awareness could spur demand, turning the halving into a self-fulfilling prophecy of bullish market sentiment.

This view also aligns with Daniel Polotsky’s insight questioning the continued relevance of Bitcoin’s four-year cycle. While demand fluctuations will continue, the impact of supply changes is becoming increasingly insignificant.

At this point, Bitcoin’s issuance rate has become so low that its supply has a negligible impact on its price, which is currently driven primarily by demand. While the narrative surrounding the halving remains a powerful driver and is expected to drive Bitcoin into a new bull market, this influence may weaken in the future. As a result, it is likely that Bitcoin will eventually break away from the four-year halving cycle.

Halving is coming!

I have fond memories of the 2020 halving. As the moment of the block reward halving approaches, the atmosphere in the Bitcoin community is full of anticipation. This pivotal event triggered an incredible wave of bullishness in the summer of 2020, setting the stage for a huge bull run in 2021. Although I remain skeptical that the modest reduction in supply caused by the halving will significantly change the price equilibrium of Bitcoin, it will stimulate increased demand and investor enthusiasm, which is something I eagerly anticipate.

From a miner's perspective, the halving brings with it a potential market rebound. It is an opportunity for us to reflect and innovate in our operations. It pushes us to explore new ways to reduce costs, improve efficiency, and ensure our survival and success in this highly competitive field. The halving is not only a test of resilience, but also a catalyst for development within the mining community.

As we look forward to the next halving, it is important to remember the core spirit of Bitcoin. Bitcoin was not created by miners; it was created for miners. Its heart beats for holders. There is no doubt that miners play a vital role, servicing the Bitcoin network and ensuring its robustness. However, the true spirit of Bitcoin lies in its ability to empower holders and provide a decentralized alternative to the traditional financial system. The anticipation and excitement surrounding the halving resonates not only with miners, but also with the entire community of Bitcoin enthusiasts and investors.

So, as this pivotal event approaches, let us embrace the halving with open arms and a spirit of innovation. It serves as a reminder of Bitcoin’s dynamic landscape, a testament to its resilience, and a beacon of exciting developments to come. For all holders and miners out there, let’s get ready for the halving. Let’s get ready!

JinseFinance

JinseFinance

JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance Sanya

Sanya JinseFinance

JinseFinance Nulltx

Nulltx Cointelegraph

Cointelegraph Cointelegraph

Cointelegraph Nulltx

Nulltx