Source: GO2MARS’ WEB3 Research

Introduction

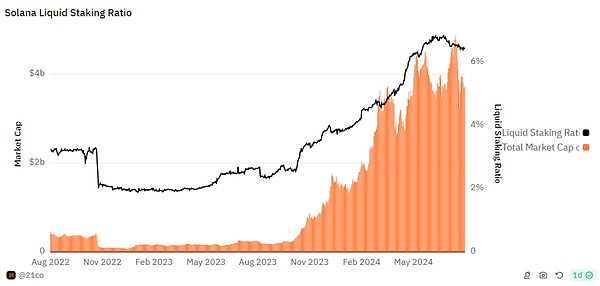

With the release of Jito’s liquidity re-staking infrastructure and Binance Labs’ investment in Solayer, Solana’s re-staking ecosystem is entering its early warm-up phase, and Solana’s current staking rate is only 6%, far lower than Ethereum’s 28%, indicating huge room for growth in the future.

In this article, we will delve into the unique characteristics of Solana’s liquidity re-staking ecosystem, compare it to Ethereum’s corresponding ecosystem, and track its development. We will explore how to use NX Finance to achieve different yield strategies in the development of Solana’s re-staking ecosystem.

Unlocking liquidity re-staking, a new chapter in Solana's ecological narrative

The re-staking mechanism was introduced by Eigenlayer, a star project in the Ethereum ecosystem. It allows Ethereum's staked ETH or LSD tokens to be used again to participate in the Active Verification Service (AVS) verification, thereby solving the problem of the AVS network attracting stakers and establishing a trust network. Through the re-staking function, EigenLayer provides an environment that enables AVS to establish a trust network based on the liquidity recruited through EigenLayer, while providing re-stakers with the opportunity to participate in AVS network verification and earn additional verification rewards.

AVS under the Eigenlayer framework mainly maintains the off-chain network and uses the base chain (Ethereum in EigenLayer) to establish a secure consensus through mechanisms such as slashing or on-chain verifiable proofs. Examples of these services include cross-chain bridges, shared sequencers, oracle networks, etc. They do not run directly on the main chain, but as a supplementary system, using the security of the main chain to enhance their own trust and verification capabilities. We call this type of AVS exogenous AVS.

However, in the Solana ecosystem, the AVS of the re-staking ecosystem is mainly used to support dapps on the chain within the ecosystem. In addition to providing economic security consensus, it also provides dapps with more block space and priority transaction packaging rights based on Solana's swQoS (stake-weighted Quality of Service) mechanism. We call this type of AVS endogenous AVS (e-avs).

The swQoS mechanism is a resource allocation model in the Solana network. It allocates network resources, such as block space and transaction processing capabilities, based on the number of tokens staked by the validator in the Solana network. In the Solana blockchain, this mechanism allows validators with more stakes to obtain more network transmission rights, thereby improving the security and efficiency of the network. For example, validators with a higher staking ratio, such as 2%, have greater capacity and higher priority when submitting transactions than validators with a lower staking ratio, such as 0.2%. This mechanism can effectively reduce junk transactions in the Solana network, which not only improves the security of the network, but also improves the reliability of transactions.

After dapp creates its own e-avs, it can add various incentives to attract Solana in its hands and then stake it into the verification node, thereby increasing its influence in the network and obtaining transaction priority packaging rights and block space resources.

Early Ecosystem, Practice of Liquidity Re-staking Projects on Solana

In the rapidly developing Solana re-staking ecosystem, projects such as Jito, Solayer and Fragmentric are actively preparing to launch or have already launched their liquidity staking tokens. It is particularly worth mentioning that Solayer has attracted 1.13 million Solana tokens to participate in the re-staking process since its launch, and has performed well.

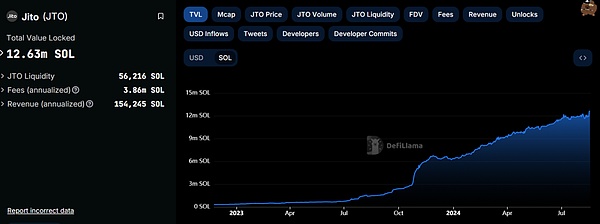

Jito has developed a highly modular re-staking infrastructure for any SPL-20 token, similar to Symbiotic in the Ethereum ecosystem, focusing on providing customized security models. As the leading liquidity staking protocol on Solana, Jito's vault holds more than 12 million SOL through the JitoSOL liquidity staking vault. Since the announcement of the launch of the re-staking infrastructure, capital inflows have accelerated significantly, and some projects have integrated this innovative solution, such as Ethereum's Renzo and Solana's Squads, and launched their native liquidity re-staking tokens on Solana.

Solayer provides a powerful means to guarantee block space and transaction priority for dapps with strong demand for transaction validity in trading, clearing, and derivatives trading by supporting dapps to create their own e-AVS and apply the staking weight quality of service (swQoS) mechanism. Since the deposit function was opened two months ago, the number of Solana tokens staked on the Solayer platform has exceeded 1.15 million.

Fragmentric is a liquidity re-staking project that has not yet been officially launched. The project founder comes from the Solana OG community Madlads community, and will release its liquidity re-staking Solana $fragSOL later. We will also continue to follow its development.

How to obtain various benefits of the Restaking ecosystem through NX Finance

As mentioned earlier, the liquidity re-staking tokens on Solana are about to become an important source of income assets. In order to attract more Solana tokens for re-staking and promote the growth of its projects, dapps compete for users' Solana tokens by providing incentives such as points that can be exchanged for airdropped tokens in the future or direct cash rewards. This creates more assets with built-in yields in the Solana ecosystem.

As the yield layer in the Solana DeFi structure, users can execute different strategies on different assets in NX Finance according to their risk preferences.

For interest-bearing assets, NX provides a strategy called Fulcrum, in which lenders deposit stable assets in a pool, and borrowers borrow stable assets to purchase target assets that want leveraged returns. Under this strategy, borrowers with high risk preferences leverage their income, and lenders with low risk preferences use stable assets to earn interest from them.

For point mining, NX's Gold Mining strategy allows borrowers to pledge assets, borrow to increase their airdrop points, and deposit in the target protocol to receive rewards. Lenders earn interest on these loans, providing risk-free profits. It caters to different risk preferences, allowing low-risk takers to obtain leveraged pledge interest, while high-risk seekers can maximize airdrop positions, providing a flexible strategy that also achieves risk redistribution in the time dimension.

Since its launch, NX Finance has obtained a total TVL of 15m through JLP assets, and the team is actively expanding its ecosystem and accessing more high-quality assets in the Solana ecosystem. The sSOL Pool issued by Solayer will be launched soon. In the next wave of Solana's re-staking, we can look forward to NX's performance.

JinseFinance

JinseFinance

JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance Kikyo

Kikyo Aaron

Aaron Coinlive

Coinlive  decrypt

decrypt Cointelegraph

Cointelegraph