The 2024 US presidential election has become one of the most watched elections in recent years. Although most people expected the election to be extremely close, the results of the election still surprised many people. Not only did Trump win the presidential election in a convincing manner, but the Republican Party also won a majority in the Senate and the House of Representatives. Such an overwhelming victory will give the Republican Party enough political leverage to promote multiple changes in the next few years. The cryptocurrency field is expected to usher in major changes, and we believe that the next 12 months will be a favorable period for crypto assets.

Crypto Agenda

One of the differences between the 2024 election and previous ones is that there is a "crypto agenda" this time, and the winning president and his core advisory team are friendly to cryptocurrencies. Cryptocurrency companies have strongly supported Trump and key Republican candidates through donations. Therefore, it is not surprising that the crypto industry has become one of the main beneficiaries of this Republican victory.

There has been a lot of discussion about what this election means for the crypto industry, but here are a few of the main impacts:

Changes in SEC policy. Under Gary Gensler, the SEC and other appointees of the Biden administration have implemented aggressive regulation of the crypto industry. Despite repeated calls from the industry for regulatory guidance, the SEC has insisted on managing through enforcement actions. During Gensler's tenure, more than 2,700 enforcement actions were initiated and fines totaling $21 billion were issued. This has made it difficult for many projects to do business in the United States.

Trump made it clear during the campaign that if elected, he would replace Gensler. Sure enough, last week Gensler announced that he would resign as SEC Chairman on January 20, 2025. Several candidates have been nominated to take over, and they are generally seen as more supportive of the crypto industry. This means that existing enforcement actions may be revoked and the SEC will take a more collaborative regulatory approach.

Improvements in the congressional environment. In the past, a major challenge facing the crypto industry was that it was difficult to pass any favorable bills in the U.S. Congress because most members either lacked understanding of cryptocurrencies. However, after this election, about two-thirds of members of Congress are considered pro-cryptocurrency. This will likely bring about a regulatory framework that supports innovation, making it easier for projects to raise funds, and clearing the way for institutional capital to enter the crypto field.

Proposal for a strategic bitcoin reserve. During the campaign, Trump told his crypto supporters that if elected, he would push for the establishment of a strategic bitcoin reserve instead of allowing the U.S. government to continue to dispose of previously seized bitcoins. This proposal quickly gained attention after the election. If this proposal goes through, the market will begin to speculate whether this means that the US government will become a net buyer of Bitcoin rather than a seller. If MicroStrategy alone can influence the price of Bitcoin, imagine the impact of the US government establishing a strategic Bitcoin reserve. More importantly, how will other countries react to this? Will they also propose similar plans?

DeFi support. Even before the election, the Trump-backed team launched World Liberty Financial in September 2024, aiming to provide decentralized lending services and achieve governance through the native token WLF. The project has raised more than $50 million to date, with the latest investment coming from crypto entrepreneur Justin Sun, who invested $30 million this week. WLF plans to raise a total of $300 million. Whether it eventually raises 300 million or 50 million, the significance of this project is far greater than its amount - it provides a huge encouragement to DeFi developers and innovators. More importantly, this DeFi project supported by the incoming US president will have a profound impact on the entire industry.

Each of the above events alone would have been enough to significantly boost the crypto market, but the combination of these events has had a far-reaching impact on the crypto industry. The market has not yet fully reflected the potential impact of these changes, which is why the US media has called this period the "Golden Age of Crypto."

In addition to all of the above, Trump has also expressed his desire to make the United States the "global crypto capital." To some extent, the United States is already the de facto crypto leader. Many major infrastructure projects, some of the largest blockchain infrastructure companies, and decentralized applications originated in the United States. The United States also has the world's largest licensed cryptocurrency exchange, the largest crypto investment bank, and the largest Web3 venture capital pool.

In addition, the United States accounts for about 40% of the world's Bitcoin mining computing power (compared to 17% in 2021), making it the largest center for Bitcoin mining. Most of the world's crypto transactions are also denominated in US dollars, and major stablecoins are pegged to the US dollar.

So, in many ways, the US is already the global crypto hub. However, if the US government plans to consolidate or further expand its dominance, what does this mean for other governments, especially major financial centers such as London, Tokyo, Dubai, and Hong Kong? More importantly, can Europe afford to miss out on the Web3 innovation era and fall behind again after the Web2 era?

Some may question whether Trump will actually deliver on these promises, but I think the chances are high. Trump does not follow traditional rules, and the political leverage brought by this election victory is very strong.

In addition, Trump has two crypto native advisors around him, Elon Musk and JD Vance. New Commerce Secretary Howard Lutnick is also the chairman and CEO of Cantor Fitzgerald, which just acquired a 5% stake in Tether (the issuer of the world's largest stablecoin USDT). Coupled with a friendlier pro-crypto Congress, it should not be difficult to push these initiatives.

Altcoins Outperform Bitcoin

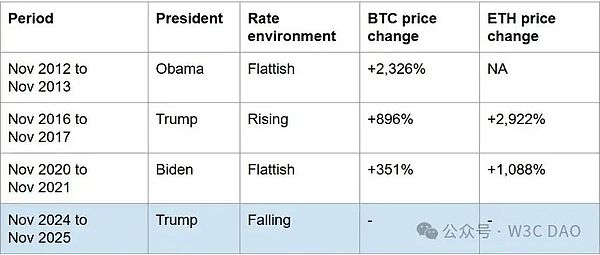

Against the above backdrop, it becomes particularly important to discuss the impact of all this on crypto asset prices. As can be seen from the table below, historically, the 12 months following US elections are typically a period of strong performance for crypto asset prices.

There are two main observations here:

Crypto assets have performed very well in the 12 months following US elections, regardless of who wins the presidential election and what the interest rate environment is like. We attribute this to two factors:

a) the clarity brought by the election results and the optimism about the new administration;

b) the continued momentum of the Bitcoin halving cycle/crypto cycle.

In the 12 months following the past two elections, altcoins (represented by ETH) have returned about 3 times that of Bitcoin.

As of 30 days after the 2024 election, Bitcoin is up 46% and Ethereum is up 58%. We believe there is still significant upside over the next 11 months.

To better understand the opportunities for altcoins, let's look at the chart below, which shows the performance of altcoins relative to Bitcoin. As you can see, there are stages in the cycle where altcoins outperform Bitcoin by a wide margin. We call these stages "altcoin cycles" or "altcoin seasons." The last major altcoin cycle occurred in January 2021 and peaked in November 2021. The previous cycle started in February 2017 and peaked in January 2018.

It is noteworthy that these altcoin cycles roughly overlap with the 12-month period following the election. We believe the main reasons are the strong price performance in the first few weeks after the election and the shift in investor sentiment towards risk appetite.

Furthermore, this trend has attracted retail money into the crypto asset class, which tends to prefer riskier small and mid-cap coins as they are not subject to the liquidity constraints of institutional investors. In addition, at this point in the cycle, altcoins tend to underperform, making their risk-reward ratio more attractive compared to large-cap coins. This is also the case in this cycle.

If this historical relationship holds, then we should expect the altcoin season to begin soon.

JinseFinance

JinseFinance

JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance Cointelegraph

Cointelegraph