Author: Stacy Muur Source: substack Translation: Shan Ou Ba, Golden Finance

Since 2023, new Ethereum Layer 2 solutions have continued to emerge, and L2Beat currently tracks data for 74 L2s and 30 L3s. However, only a few general-purpose rollups have gained mainstream attention, attracting a large amount of total locked value (TVL) and users.

These rollups are the focus of my new research.

Growth Catalysts

For many Ethereum L2s (such as ZKsync, Starknet, and Blast), airdrops have been the main means of acquiring users.

Today, you’ll discover how they really performed after their airdrops and compare them to other examples: chains that launched their tokens a long time ago (like Arbitrum and Optimism), chains that had tokens from day one (like Scroll and Linea), and other chains that haven’t launched their tokens yet.

There are currently three active airdrop activities:

Scroll: "Scroll Sessions" and "Scroll Canvas"

Linea: ="text-align: left;">Mantle: 'Metamorphosis' of Upcoming Governance Token COOK, for mETH (LST) and cmETH (LRT)

Ongoing airdrop campaigns will increase user activity, so please be aware that data from Scroll, Linea, and Mantle may not be entirely objective. User activity may drop after these campaigns.

Metrics Comparison

This publication will include a lot of visuals as they are the best way to compare Ethereum L2 and illustrate its current state and progress.

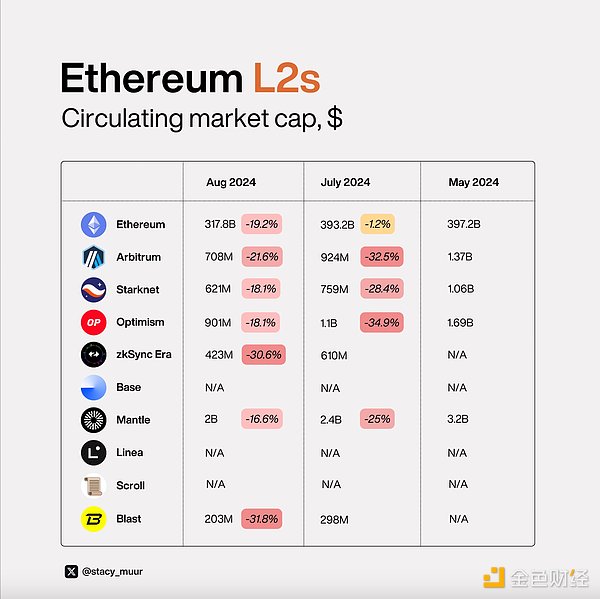

Market Cap: Circulating and Fully Diluted Market Cap

Currently, most L2s have fully diluted valuations (FDVs) in the billions of dollars, but circulating market caps below $1 billion, indicating that a large portion of their tokens are still not circulating. Mantle is an exception, with 52% of its supply unlocked, making it the only L2 with a circulating market cap of more than $1 billion.

This high FDV and low floating standard is a key reason why many recent airdrops have failed to meet user expectations. It is challenging to assess the current valuation adequacy, and it is uncertain whether there is much downside potential in the future.

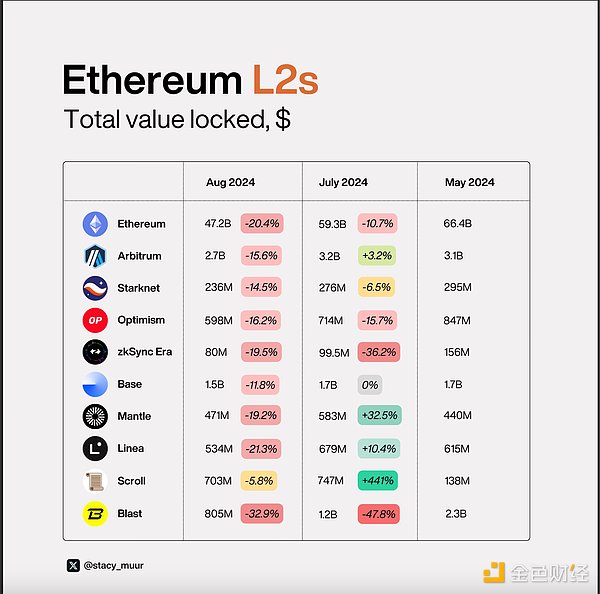

Total Locked Value

From the TVL perspective, except for blockchains such as Scroll, Linea, and Mantle, which are implementing incentive programs, all blockchains have experienced a difficult summer. However, compared with newly announced programs such as Scroll, Linea's airdrop program, which has lasted for nearly a year, has attracted less attention from the community.

ZKsync and Blast were the most affected, as these two chains launched their own tokens this year, causing liquidity to migrate to more profitable places.

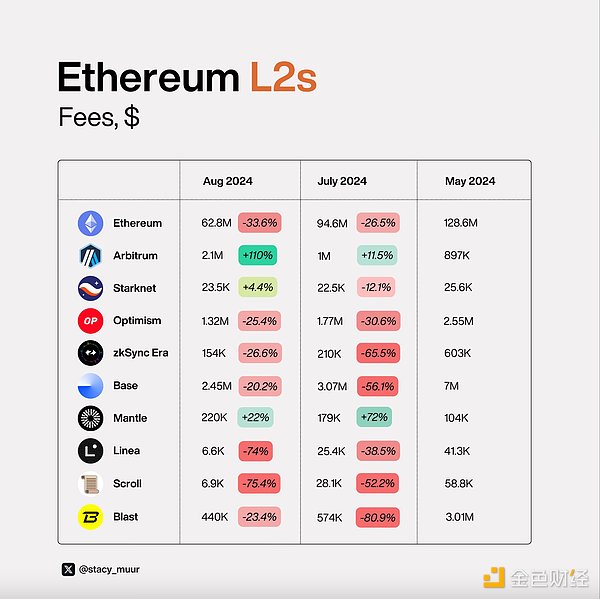

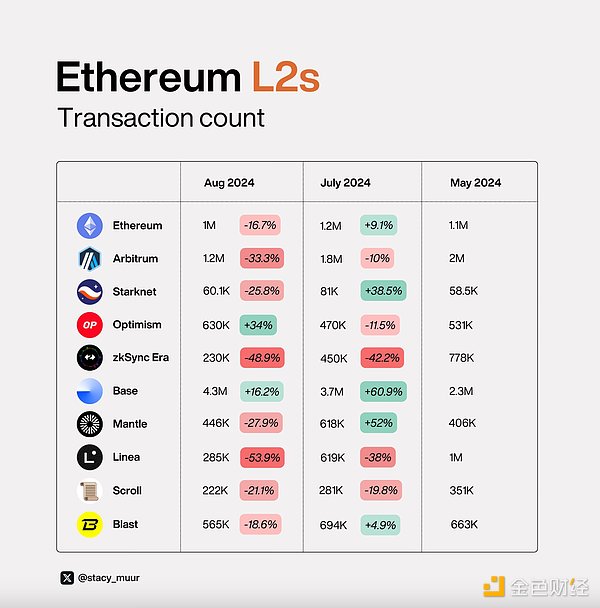

Fees and transaction activity

After Dencun, DA is no longer a significant value driver for the ETH economy, affecting not only Ethereum fees, but also fees generated by L2.

Fee dynamics should be evaluated together with transaction volume, as they are always interrelated. Dencun’s impact on fees may obscure the true picture of user activity.

Base, known as the primary destination for new memecoin launches on Ethereum L2, is showing strong traction and continued transaction growth, driven by speculation.

In contrast, ZKsync and, surprisingly, Linea are struggling, despite Linea’s ongoing incentive program. Monthly Active Users (MAU), a key metric for evaluating chain retention, also shows a similar trend. Mantle and Base perform best, while Starknet, ZKsync, and Blast lag behind.

When comparing MAU data to FDV, it is clear that Starknet is severely overvalued compared to Arbitrum, Optimism, and even ZKsync.

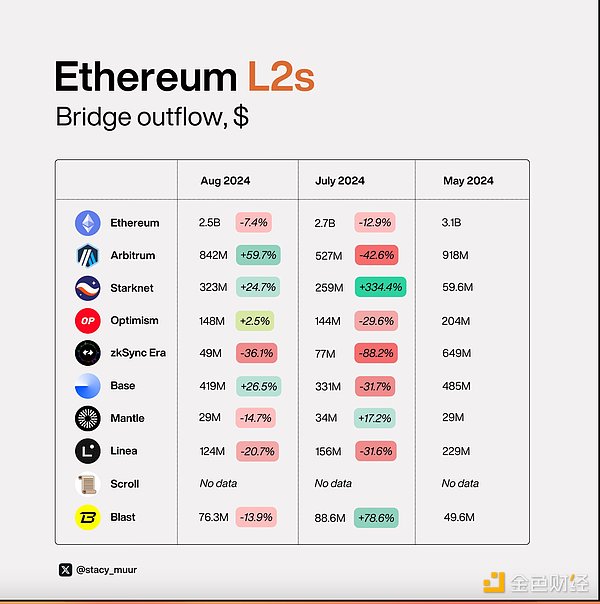

Bridge Inflows and Outflows

Bridge Net Flow is an important metric for assessing new users and capital inflows.

In L2, those with positive net flows (more inflows than outflows) include Arbitrum, Starknet, Optimism, Base, and Mantle, with Mantle having the largest difference between outflows and inflows.

On the contrary, Linea, ZKsync, and Blast exhibit negative net flows.

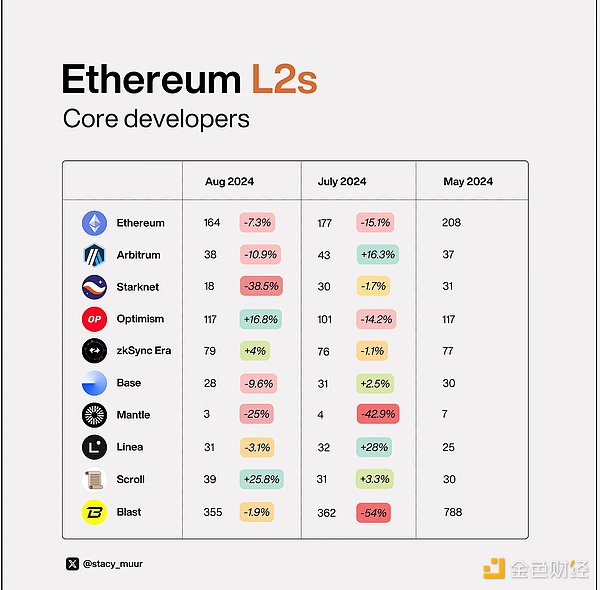

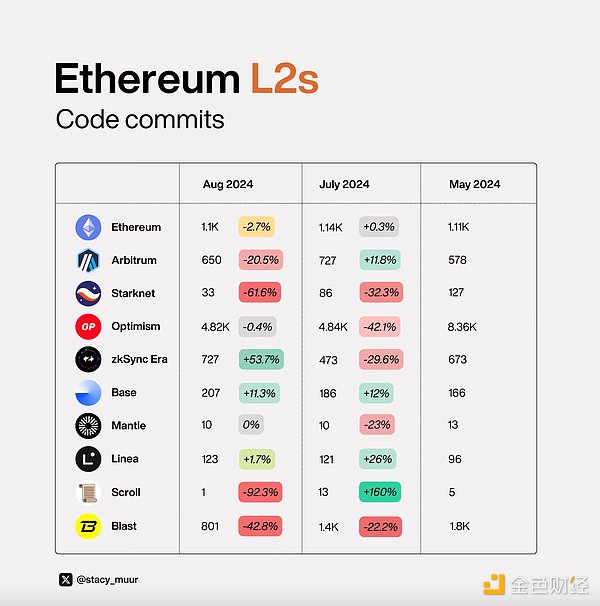

Developer Activity

Finally, developer activity is measured by the number of core development and code commits. This data helps assess the team's current productivity and detect any ongoing staff cuts.

The most surprising case here is Blast, which now has over 300 core developers (while most L2s usually have only 30-50). This large team also commits a lot of code.

What are they all doing there? Who knows.

Summary

Mantle

Mantle's ongoing Metamorphosis campaign has been quite successful, judging by bridge net flows and MAU data. Although some metrics declined in August, this has more to do with the overall crypto market decline than Mantle's retention issues.

Base

Base launched its Onchain Summer II campaign on June 3rd, which runs until August 31st.

During this period, market cap increased by $100 million, while bridge outflows increased by $87.7 million. Additionally, the number of transactions on the network surged by 2 million from May to August, and the number of daily users grew by 474.71K. While the event gained attention from users, it did not significantly impact inflows or the protocol’s revenues.

Blast

The developers released the airdrop on June 26, 2024. As the overall market fell, the protocol’s metrics began to trend downward after the initial hype:

From May to August, TVL fell by $1.49 billion. Users may have withdrawn their locked-up reward funds after receiving the airdrop. This view is supported by the increase in outflows through the bridge of $26.7 million in three months.

From July to August, the number of transactions decreased by 128.9K and the DAU decreased by 21.93K.

The protocol’s revenue and fees fell by $2.57 million in three months.

After the airdrop, user activity dropped significantly, and overall market conditions further dampened user engagement.

Scroll

On April 17, 2024, the developers announced the launch of Scroll Sessions . Since then, the stablecoin’s market cap has increased by $7.78 million, and its TVL from May to August has increased by $565.4 million. Although the metric has fallen by $43.8 million in a month, it is still significantly higher than the level in May.

The number of transactions in the network has decreased by 129K in three months. As a result, TVL and stablecoin capitalization grew, while the number of transactions did not (the "deposit and forget" strategy of airdrop mining). It is worth noting that the project's MAU metric fell sharply by 399K in the same period.

Linea

On July 1, 2024, Linea developers launched another event, Linea Culture SZN. This triggered a wave of backlash on social media, as users had believed that Linea Park would be the last game. After the news was announced, they felt deceived.

This may have led to a decline in several protocol metrics:

The market capitalization of stablecoins fell by $47.7 million in three months.

Between May and August, TVL has dropped significantly by $144.67 million.

Fees and protocol revenues have dropped by about 2.8x per month, and 5-6x in 3 months.

There has been a noticeable decrease in outflows and inflows through the bridge, as has the number of daily transactions - 333.7K per month, and 714.4K in 3 months.

Daily Active Users (DAU) have also dropped significantly by 324.5K since May.

It can be assumed that the campaign has failed to attract user attention, especially in light of the overall market decline.

Starknet

Starknet’s metrics have dropped significantly, losing popularity among users after a drop in February.

TVL dropped by $58.9 million in three months, and $40.2 million in one month alone. The number of transactions dropped sharply from July to August.

Final Thoughts

If I were to rank L2s by conviction, the list would be:

Arbitrum:Controls 40% of L2 TVL, has a large number of active users, MAUs are almost the same as Ethereum, and has strong DeFi capabilities.

Mantle: Has the second largest treasury in Web3, has good user retention, has the highest percentage of tokens in circulation in L2, and is gaining traction with its upcoming COOK derivatives and native DeFi products like mETH.

Optismism: Has the OP Superchain thesis, but has seen a drop in user activity compared to Arbitrum, despite comparable FDV.

Base: Exhibits high transaction activity, mostly associated with memecoins, which tend to have short lifecycles.

Linea: Shows average metrics for ongoing airdrop activity. Although the initial excitement has faded, Consensys may bring something worth noting.

ZKSync and Scroll: ZKSync has good tech and developer activity, despite poor airdrop execution leading to reduced user activity. Scroll has seen a large influx of users into the airdrop, but its long-term sustainability is questionable.

Blast and Starknet: No comment needed; the data speaks for itself.

JinseFinance

JinseFinance

JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance Cointelegraph

Cointelegraph Cointelegraph

Cointelegraph