Author: Climber, Golden Finance

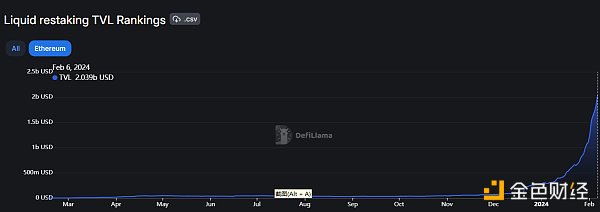

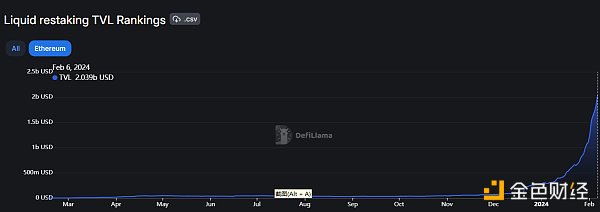

On February 6, the Ethereum liquidity re-pledge agreement TVL exceeded US$2 billion, of which ether.fi TVL exceeded US$750 million, with a monthly increase of 500%. The increase ranked first, followed by Puffer Finance and Kelp DAO. The TVL of Renzo and Eigenpie also exceeds US$200 million.

The popularity of the previously re-pledged star concept projects EigenLayer and AltLayer has continued to attract traffic to this narrative, which has led to the rapid development of multiple projects of the same type. The upgrade of Ethereum Shanghai last year has led to the rise of the liquidity staking track. After a period of development, the re-staking method has evolved.

Ethereum is about to usher in the Cancun upgrade this year, and the re-staking track may usher in an explosion. Recently, the TVL of many re-pledged projects has increased significantly, and the market expects that there may be potential projects among them. Today, Golden Finance will conduct a comparative analysis of these representative players from multiple dimensions to find out the value points in each project.

On-chain data

Currently, EigenLayer’s TVL is approaching US$4 billion. On February 4, EigenLayer’s TVL just exceeded US$2 billion, but just three days later, this figure nearly doubled. The big reason is that EigenLayer reopened the re-staking window, adding LST sfrxETH, mETH and LsETH, and there is no upper limit for any LST, but the window period is only until February 10.

Just looking at the current growth rate and scale, EigenLayer far exceeds similar projects, and its development trend is still rapid.

Look at ether again. fi, its TVL is US$778 million and has grown by more than 500% in the past month. In second place is Puffer Finance, but the TVL is only half that of ether.fi, at about $476 million.

The TVL of other re-pledge projects Kelp DAO is US$320 million, with a monthly increase of 121%; Renzo TVL is US$215 million, but the monthly increase is as high as 826%; Eigenpie TVL is approximately US$200 million.

Financing information

EigenLayer:

In August 2022, EigenLabs, the developer of EigenLayer, completed 14.5 millionUSD seed round financing, co-led by Polychain Capital and Ethereal Ventures.

In March last year, EigenLabs completed $50 million in Series A financing, led by Blockchain Capital, including Electric Capital, Polychain Capital, Hack VC, Finality Capital Partner, Coinbase Ventures and IOSG Venture Waiting for participation.

ether.fi:

In February 2023, ether.fi completed 5.3 million financing from North Island Ventures, Chapter One and Node Capital Co-led the investment, with participation from BitMex founder Arthur Hayes and others.

Puffer Finance:

In June 2022, Puffer Finance completed a Pre-seed round of financing of US$650,000; in August 2023, Puffer Finance completed US$5.5 millionSeed round financing; in January 2024, Puffer Finance completed strategic financing with an undisclosed amount.

Kelp DAO :

On October 7, 2021, Stader Labs announced the completion of $4 million seed round financing, led by Pantera Capital and Coinbase Ventures , True Ventures, Jump Capital, Proof Group, Hypersphere, etc. participated in the investment.

On January 20, 2022, Stader Labs announced the completion of $12.5 million private placement financing at a valuation of 450 million. This round of financing was led by Three Arrows Capital, with participation from Blockchain com, Accomplice, DACM, GoldenTree Asset Management, Accel, Amber, 4 RC, Figment and many angel investors.

Renzo:

In January 2024, Renzo Protocol completed a $3.2 million seed round of financing with a valuation of $25 million.

Major project events

EigenLayer:

On February 4 this year, EigenDA, EigenLayer’s data availability solution, was integrated into Arbitrum Orbit .

In December last year, EigenLayer introduced six new liquid staking tokens (LST).

In November, EigenLayer launched the second phase test network of EigenLayer and EigenDA. The second phase main network is expected to be launched in the first half of 2024. The third phase will introduce AVS (Active Verification Service) outside EigenDA, and it is expected that the third phase will enter the test network and main network in 2024.

In April, EigenLayer released the first phase testnet of the EigenLayer protocol on the Ethereum Goerli network. The first version of the white paper was released in February.

ether.fi:

On January 10 this year, ether.fi announced its roadmap for the first half of 2024. The team has set TGE in April, with other key dates including the release of the DAO framework in February, the release of the token economics document in March, and the launch of the token generation event in April. Mainnet v3 is scheduled to be released in early Q2 and will include special features such as the ability for users to run personal nodes with 2 ETH Bond.

In May last year, Ether.Fi launched the first phase of the mainnet.

Puffer Finance:

In January this year, Binance Labs and LBank Labs announced their investment in Puffer Finance; in May last year, they received a grant from the Ethereum Foundation.

Renzo:

In January this year, OKX Ventures announced a strategic investment in Renzo; in October last year, Renzo was launched on the mainnet.

Conclusion

The re-staking track has continued to be popular recently and shows no signs of stopping. With the arrival of the Ethereum Cancun upgrade, it is very likely to usher in another wave of re-staking. Come on heat. As an emerging sector, it also has a hype gimmick. Therefore, investors can pay long-term attention and make appropriate arrangements.

JinseFinance

JinseFinance