Author: Li Jin, Partner at Variant Fund; Translation: Jinse Finance xiaozou

A typical application of cryptocurrency in the market is as a mechanism to drive growth: using tokens to incentivize the inflow of supply and/or demand. Various DePIN networks and other market tokenizations have successfully applied this model to overcome the cold start problem.

In analyzing market tokenization, we have formed a framework to think about various market tokenization methods and the pros and cons of each method.

At the most basic level, the market facilitates transactions between supply and demand. Over the past few decades, we have witnessed various evolutions of the market. These evolutions have either unlocked new sources of supply and demand or summarized excellent experiences for existing supply and demand participating in the market.

In short, markets can be divided according to whether they target new supply or existing supply, and meet new demand or existing demand.

First, let’s look at the specific definitions:

Marketplaces that cater to new needs expand the market for a product or service by converting former non-consumers into consumers. For example, UberX essentially converts consumers who previously used other modes of transportation (public transportation, private cars, etc.) into rideshare users.

Marketplaces that cater to new supply are expanding the market for a product or service by activating non-suppliers who previously did not provide a service or product to become suppliers. For example, Airbnb adds new supply on the host side in the form of more bedrooms or couches.

Marketplaces that tap into existing demand are pulling existing users of your product or service to new marketplaces. Think about this: Angie’s List’s superior vertical experience may pull existing demand away from more comprehensive marketplaces like Craigslist.

Similar to the previous point, but for suppliers. Take Faire, a B2B wholesale marketplace that connects brands and retailers.

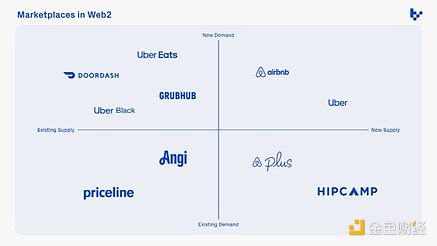

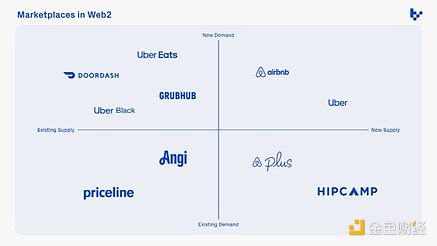

1, Web2 Marketplaces

Borrowing the Web2 approach to marketplaces can help. We can better understand market dynamics by looking at the history of marketplaces and how the biggest successes were created.

The biggest disruptions in Web2 market innovation—and therefore the biggest results—happen in the "new supply + new demand" quadrant. When you open up new supply and new demand, you make the whole pie bigger. This echoes Clay Christensen's view of disruptive innovation: Christensen believes that focusing on previous non-consumers can open up a larger market than locking in existing consumers.

Compared to the "existing supply + existing demand" quadrant, markets in this quadrant often take existing transactions (Whitepages, travel agencies, etc.) and build better products to serve these transactions. For example, Priceline for travel reservations and OpenTable for restaurant reservations. The convenience and ease of digital discovery and booking allow them to create experiences that are 10x better than offline marketplaces, enabling them to capture market share.

There are two quadrants left: one where the supply is still there but the demand is new; the other where the demand is still there but new supply has emerged. In both cases, growth can come from the conversion of new consumers or suppliers. There is a large amount of business coming from these quadrants. For example, DoorDash has created a new source of demand for existing restaurant supply (consumers wanting food delivered on demand). By converting non-consumers to consumers, it has opened up a new revenue channel for restaurants - DoorDash had $2.3 billion in revenue last year.

Obviously, there is overlap in these quadrants, and markets often start in one quadrant and then migrate or expand into other quadrants. However, this framework helps quantify the size of the potential market based on the existing market dynamics and the potential supply and demand.

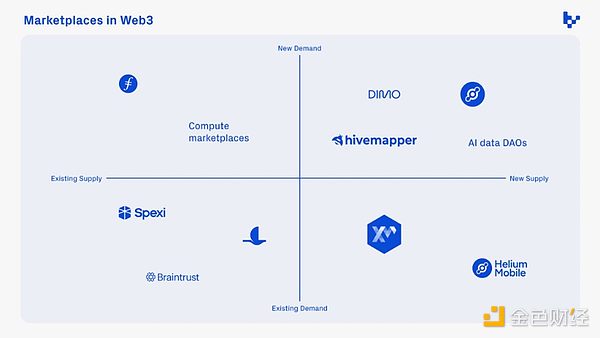

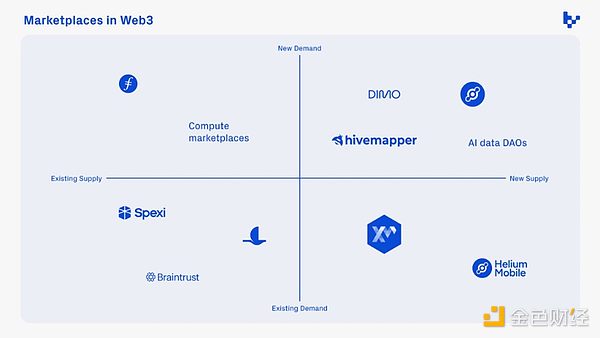

2, Web3 Market Matrix

Similar to web2 markets, there are four general ways to categorize market tokenization.

Occupying the “Existing Supply + Existing Demand” quadrant are marketplaces that seek to improve upon existing platforms—for example, by offering better products or better economics for participants. For example, Braintrust is a freelance marketplace that shares ownership with users through tokens, charging a lower commission rate than the industry standard of 40% for human resources agencies. Blackbird is a restaurant loyalty platform that targets existing restaurants and offers a lower commission rate for payments in cryptocurrency.

In the “New Demand + New Supply” quadrant, businesses can create entirely new markets. For example, DIMO allows drivers to earn tokens by transmitting their vehicle data, unlocking new pools of supply and demand in the automotive data space. Drivers who would not otherwise provide vehicle data are attracted to the network by token incentives, and this new supply of data unlocks new demand. Helium is another example: individuals set up hotspots at home and are rewarded for creating a decentralized wireless IoT network using the LoRaWan system.

Market tokenization fits nicely into the “new demand + new supply” quadrant, as token incentives allow for orderly growth of the market by subsidizing one party to join the market before the other. This is a new capability compared to the web2 paradigm, where markets must scale both supply and demand.

The risk of building a “new supply + new demand” quadrant is that supply or demand is not sufficient to underlie a large revenue opportunity, or that new suppliers and/or new demand take longer to emerge than expected. However, founders may also underestimate the size of an emerging market. For example, the Uber founders estimated in their seed round presentation that, in the most optimistic case, they should have annual revenue of $1 billion. This turned out to be a significant underestimate of the potential demand for transportation — Uber had revenue of $8.7 billion last year. Founders must prepare for both possibilities, develop flexible business models to scale quickly if the market response is stronger than expected, and also develop contingency plans for situations where growth is lower than expected.

3 Impact on Builders

Understanding whether the new market is for new supply and demand or existing supply and demand is critical because it determines the entry strategy and what aspects builders need to stand out in order to win the market's supply and demand share.

To activate new supply, builders must educate potential suppliers on why they should participate in this new market and provide an attractive value proposition. This usually requires convincing them that they will receive monetary or other benefits.

If the value proposition is money, then builders must ensure that their solutions are competitive in the broader revenue opportunity market. For example, GPU resource suppliers can choose to rent to different GPU markets, so the revenue potential of the new platform must be attractive enough. Whether one is participating as an active or passive supplier is another factor that influences retention and scalability.

Finding existing suppliers and convincing them to switch to a new platform requires developing a strong product and go-to-market campaign, depending on the nature of the supply. If the existing supply consists of businesses (B2B), founders build relationships with these suppliers and benefit from them. If the existing supply consists of individuals (B2C), founders need to have strong storytelling and marketing skills, as well as the ability to translate deep user insights into products.

Creating new demand requires builders to excel in new market creation. Founders must effectively communicate why this new product or service is valuable and worthy of user attention. This requires skilled storytelling and narrative building, as well as a strong set of customer acquisition skills. In the crypto space, token incentives can also help drive new demand for the market.

To win existing needs, founders need to be good at acquiring customers, satisfying potential users’ needs, and convincing them to switch to a different platform. This requires understanding their current needs and providing a significantly better solution. For example, new vertical on-demand market disruptors convert users from Craigslist and other general platforms through a 10x better user experience. In the crypto world, using token incentives to convince end users to switch to new platforms is an effective strategy, as demonstrated by various vampire attacks and token incentive programs.

4, Market Tokenization Prospects

Market tokenization is unique in the crypto world because they face competition not only from other crypto projects, but also from all other web2 markets in the vertical field. This is because Web3 markets deploy token incentives as a bootstrapping mechanism, while the core of the market still depends on the success of transactions. For example, tokenized GPU compute marketplaces like Ionet, Akash, Render, and others compete with traditional compute services like Lambda, Coreweave, and AWS.

The lifeblood of any marketplace is liquidity—the ability to find counterparties for targeted transactions. While token incentives can drive initial growth and help overcome cold start problems, long-term success still depends on the core utility of the marketplace: matching supply with demand. Ultimately, tokenized marketplaces must build strong enough markets with a superior experience to attract and retain participants.

JinseFinance

JinseFinance