Author: Spinach Spinach, Web3caff Reseach & Researcher of All Things Research Institute Source: X, @wzxznl< /p>

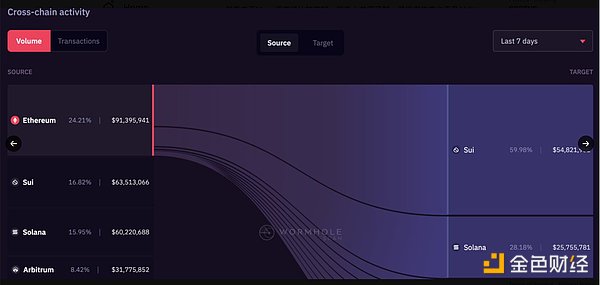

Following the last time we observed significant growth in Sui’s TVL and cross-chain activities, Sui’s surge this time has attracted widespread attention. Without doing too much research, let’s briefly review the reasons for Sui’s sudden rise, and learn about some Sui ecological projects that are currently attracting much attention.

p>

Move ecological spinach has never studied or paid attention to it before, so I don’t know much about it. But since I wrote several tweets about Move smart inscriptions, I found that In particular, it has a very strong advantage in financial application scenarios because it can realize the decoupling of asset ownership and smart contracts.

This is different from the Ethereum system. In the EVM system, if there is a security problem with the smart contract, then the assets inside will also have problems. Using Move Language can avoid such a situation. Even if there is a security problem in the smart contract, your assets will not be affected (it depends on the design of the contract. If it is a pool, there is still a risk). In short, the Move language will be more secure than Solidity. Security is more flexible.

However, because the Move language is still relatively young, many people do not understand it, and the developer ecosystem is not as good as Ethereum and Solana. It has been tepid before, but with the Following the narrative of high-performance chains and the rebirth of Solana, we believe that Sui may also usher in an ecological explosion, especially in the fields of finance, RWA, and DePIN.

Sui's recent surge is due to two main reasons:

1. The holding of the Move Ecological Conference Generally speaking, public chain meetings will most likely engage in a wave of "pull-offs" "After all, I need to give everyone a shot of chicken blood to be more motivated

2. The Sui ecological project has opened a high Extra subsidiesThis is also the main factor behind the rapid growth of TVL and cross-chain activities.

p>

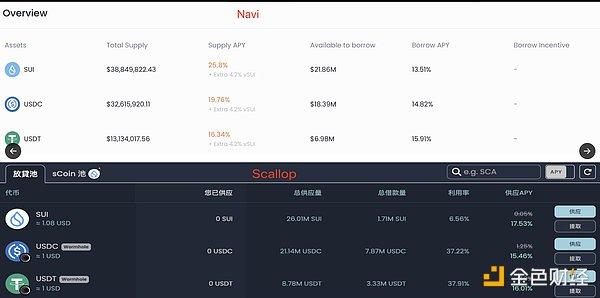

For example, the interest rates for depositing Sui and USDC on Navi Protocolare more than 20%, and the high subsidies attract A large amount of money came to harvest the wool, which also caused a large amount of Sui to be locked in the agreement and earn interest, causing a certain flywheel effect to continuously increase the price of Sui.

Sui The wave of outbreaks has also attracted widespread attention in the market. In addition to Cetus, which has issued coins, the DeFi lending projects Navi Protocol and Scallop Lend, which have not yet issued coins, have become the projects that everyone is focusing on.

For these two projects, many people in the market have analyzed the mechanism design of the two projects, and according to TVL, Scallop is called Dragon One and Navi is called Dragon Two. However, in fact, if we analyze it from another perspective, Navi is in There will be more advantages in some aspects.

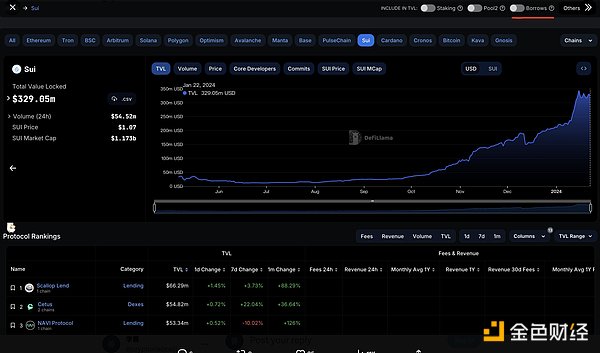

1. TVL

We can see the current Scollop on Defillma TVL is higher than Navi. Many people also judge which project is Longyi based on this, but it is too single-minded to judge based on this.

p>

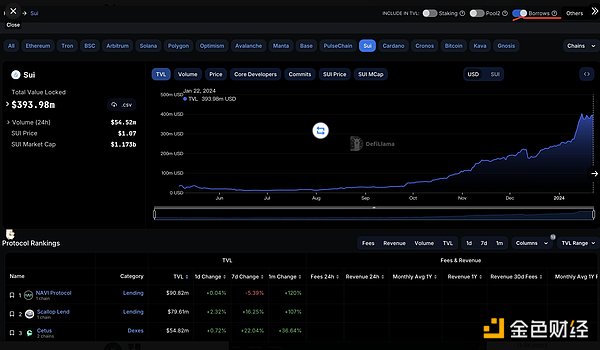

Another indicator for evaluating a DeFi lending project is the amount of borrowing activity. If we include the borrowed money, Navi’s TVL will become Sui It is an ecological Longyi project, because the default view of Defillma does not include the amount of funds re-deposited after borrowing.

p>

This logic is like comparing two banks. Bank A has more deposit reserves, while Bank B has less deposit reserves than Bank A, but Bank B has more deposit reserves. There are more loan businesses, and the "credit currency" generated through credit in Bank B's system is higher than that of Bank A, although there is currently no "credit-derived currency" in the DeFi field.

But to put it simply, Navi is higher than Scallop in terms of lending activities and scale, and the profit of a Defi lending project mainly comes from lending activities, so Navi is better in terms of real lending business.

p>

2. Yield

Another aspect is income expectations and future demand. Currently When we enter the official websites of these two projects, we can find that Navi’s return on deposit subsidies and TVL of each token are higher than Scallop’s. Counting Extra’s vSUI, Navi’s return on SUI and USDC/USDT is higher. It is around 5%~13% in Scallop.

And Scallop currently does not support revolving loans, and Navi’s deposit and loan interest rate allows users to obtain higher returns through revolving loans, such as depositing SUI to eat 25.8% + 4.2% income and then borrow SUI with 13.51% interest to continue depositing it, and borrowing local currency in local currency has almost no risk of liquidation, so Navi's yield is currently higher than Scallop.

p>

As for the future trend of SUI, what we currently know is that this high subsidy will last for one or two quarters, and since both projects are There are expectations of airdrops, which will bring a lot of TVL data. If the data looks good, it will be easier to hype, you understand.

If you want to earn airdrops through interaction, but don’t want to take the risk of SUI fluctuations, you can choose to use stablecoins to interact with them.

Navi Protocol website: https://app.naviprotocol.io/?code=404577578083422208

To summarize briefly, SUI’s current outbreak mainly comes from the lock-up positive flywheel caused by its high ecological subsidies and the holding of ecological conferences. From the perspective of the Move ecosystem, SUI’s TVL is already high. There are many APTOS, but the market value is lower than APTOS, and the future data is getting better and better, and there is more room for speculation. Currently, among the two leading DeFi projects above, Scallop is the best in terms of TVL, but if you include borrowing and lending In terms of TVL amount and loan activity volume, Navi has more advantages and higher returns. Technically speaking, the Move language has higher advantages in financial scenarios. Coupled with the advantages of high performance, the RWA and DePIN fields of the Move ecosystem may also be worthy of attention.

JinseFinance

JinseFinance

JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance Sanya

Sanya Bitcoinist

Bitcoinist