Author: Crypto Dog Source: medium

The recent rebound of BTC has rekindled the enthusiasm of investors, and in the developer circle, their building has never stopped, especially those project parties who are working on technology in one direction.

For example, Nervos Network (CKB), after launching the Bitcoin layer asset issuance protocol RGB++ in the first half of the year, has now launched CKB RGB++ Layer, which will not only ignite Bitcoin Finance (BTCFi), but may also drive all UTXO chains to take off.

Why do you say that? Let’s take a look at what’s going on. This article is mainly divided into the following aspects:

Why the primary market is optimistic about BTC Layer2

Why bet on UTXO

CKB RGB++’s disruptiveness and achievements

CKB RGB++ Layer Overview

RGB++ Layer upgrade BTCFi use case

1. Why the primary market is optimistic about BTC Layer2

Why do you think so?

First, BTC needs a usage scenario

The current market value of Bitcoin has reached $1.3 trillion, and it has always been used as a "value reserve", but this does not mean that BTC has no usage scenarios. Before the third quarter of 2023, from the perspective of WBTC as a rare way for Bitcoin to flow into the DeFi field (the market value was $11 billion at the time, less than 1% of Bitcoin's market value), the Bitcoin network actually had a large amount of asset liquidity that had not been released, and the native Bitcoin ecosystem had huge potential momentum.

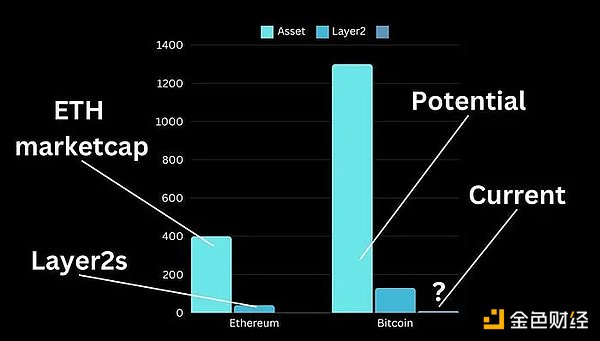

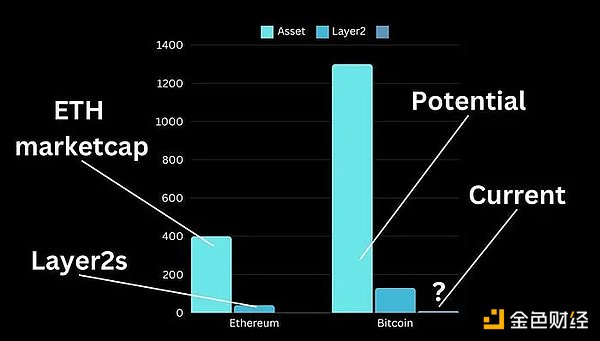

Second, the market potential of BTC Layer2 is large enough, and it may reach a potential market value of 130 billion US dollars

Regarding Layer 2, there are many industry comparison data, and the most successful one is ETH. Here is a rough example:

?Ethereum's market value is 400 billion US dollars, and Layer2s on Ethereum account for about 10% of this market value, so the valuation is about 40 billion US dollars.

?Bitcoin's market value is 1.3 trillion US dollars, which means that the market value of Bitcoin's second layer may reach 130 billion US dollars.

Third, the consensus on developing Layer2 on BTC has been formed

After the Ordinals protocol came out, the concept of inscription was completely popularized in a few months, allowing people to see that it is possible to develop an ecosystem on BTC, and it has surpassed all smart contract platforms. From the fact that all smart contract platforms have inscriptions later, it can be seen that where the community is, the consensus is.

2. Why bet on UTXO

(I) Mainstream blockchain model

In the current blockchain world, there are two main ways to keep records:

UTXO model (Unspent Transaction Output) and Account model. Bitcoin uses the UTXO model. This model is closer to cash transactions. For example, if you have a piggy bank and you receive money from someone else into your piggy bank, this money is the new coins in the piggy bank, which you have not yet spent (official term "Unspent Transaction Output"). Each coin in it can be regarded as a UTXO. When you are ready to use 10 yuan to buy a 6 yuan item, your change system will generate 2 new UTXOs for you, pay 6 yuan to the merchant, and give 4 yuan change to your piggy bank. (Understanding the UTXO model is the key to understanding RGB and subsequent content)

Account model, the Account model adopted by Ethereum. This is easy to understand, just like a bank account, how much balance there is, how much is used and how much is transferred (consumed), the system only needs to track the balance changes of the user's account, which is the model currently adopted by most public chains.

Currently, the Account model has more advantages in programmability and flexibility; in simple business and cross-chain, UTXO has its very unique and pioneering advantages.

(II) Current classification of BTC Layer2

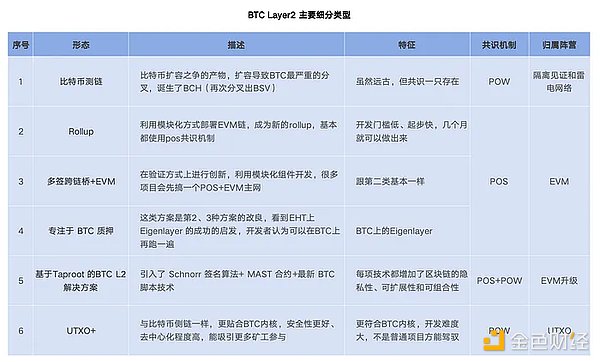

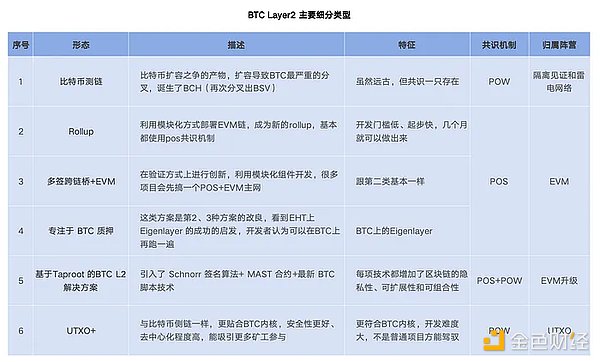

According to incomplete statistics, by June 2024, more than 200 BTC Layer2s are under development or in preparation. The current categories of Bitcoin L2 solutions are roughly state channels (such as Lightning Network), side chains (such as Liquid, Merlin), Rollups (such as Rollkit), client verification (such as RGB, RGB++, Taro), etc.

These projects can currently be summarized into two major camps:

EVM camp, this camp mainly refers to ETH's technology stack + bridge to solve BTC's expansion problem, and can be quickly built in the short term. Most BTC Layer2 adopts this solution.

UTXO camp, a school of thought based on the UTXO model, such as CKB, which proposed RGB++.

EVM camp is more about using cross-chain bridges to transfer assets on BTC and EVM chains to L2. Although the performance can be greatly improved, it cannot achieve the security of the BTC main network. Using the POS mechanism alone requires more funds to activate. Once all the users who take the airdrop are lost, the project will be declared dead.

UTXO camp belongs to a relatively original technical school. UTXO is the most distinctive data model of Bitcoin. Therefore, the Bitcoin Layer2 ecosystem is expected to present an ecological model different from that of Ethereum. Based on the UTXO architecture application, its security is naturally shared with the main chain. This model also brings a lot of expectations to the market. It is possible to build an ecological model different from Ethereum L2, which is also the expectation of the market.

The Nervos team persistently chose to extend and upgrade on the UTXO model of BTC, using a more native approach to modify the UTXO model that supports Bitcoin. Inspired by the RGB protocol, the Bitcoin layer asset issuance protocol RGB++ was created to provide Bitcoin with Turing-complete contract capabilities without the need for a cross-chain bridge.

In the long run, CKB's chain-native characteristics and underlying architecture innovation compatibility and other characteristics will allow it to go further in this BTC layer2 non-standard melee.

3. The disruptiveness and achievements of CKB RGB++

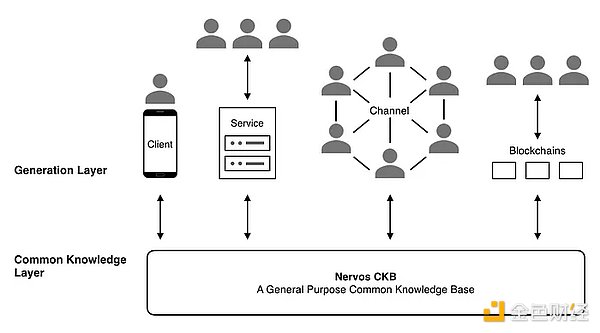

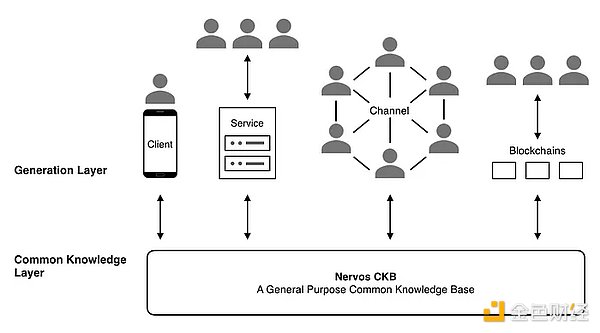

Nervos Network expands on the core technology of Bitcoin and provides support for Bitcoin Layer 2 (L2) through a scalable layer of blockchain - CKB

To improve the programming limitations of Bitcoin, Nervos Network uses a customized model (Cell model) for state storage and a customized virtual machine (CKB-VM) to execute transactions.

CKB is composed of a consensus mechanism based on proof of work (POW), a virtual machine based on the RISC-V instruction system, a state model based on Cells, a state-oriented economic model, and a peer-to-peer network.

What is RGB++?

Cipher, co-founder of CKB, creatively proposed the RGB++ protocol as a solution to the challenges currently encountered by the RGB protocol - using a Turing-complete UTXO blockchain to solve the difficulties encountered by client verification in actual operations.

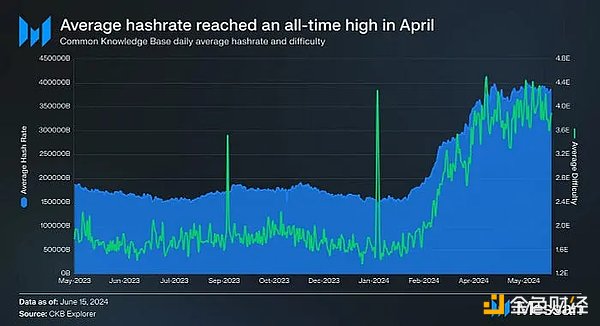

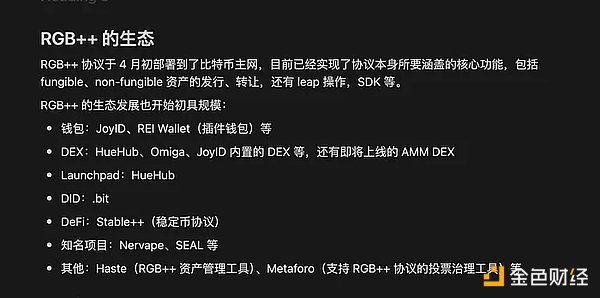

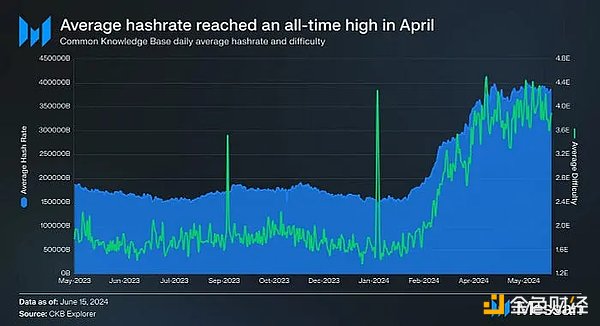

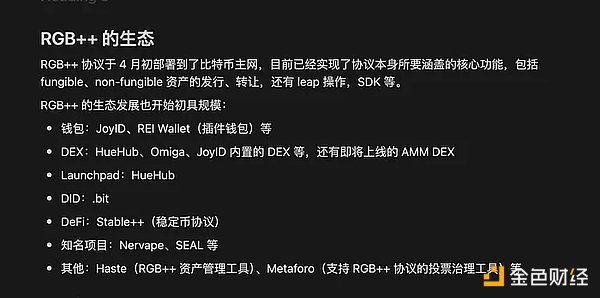

Since the launch of the RGB++ protocol on the mainnet in April 2024, the number of projects issuing assets on Bitcoin based on the protocol has surged. As a result, Nervos CKB's on-chain transaction activity has also increased rapidly. The number of new CKB addresses in April was close to 400,000, a month-on-month increase of 181%.

RGB++ is positioned as a Bitcoin layer asset issuance protocol, which means that you can use the RGB++ protocol to issue encrypted assets on the most secure and consensus-strong Bitcoin blockchain. After issuing the assets, you transfer the assets to others, and the recipient does not need to run the client for verification. This is because the assets issued through the RGB++ protocol will generate corresponding shadow assets on the CKB blockchain.

After understanding the above fundamentals, we can understand the CKB RGB++ Layer that CKB is preparing to launch recently.

Fourth, Overview of CKB RGB++ Layer

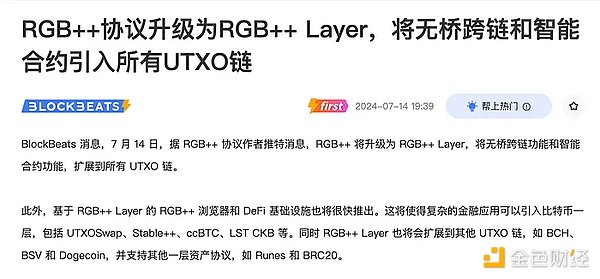

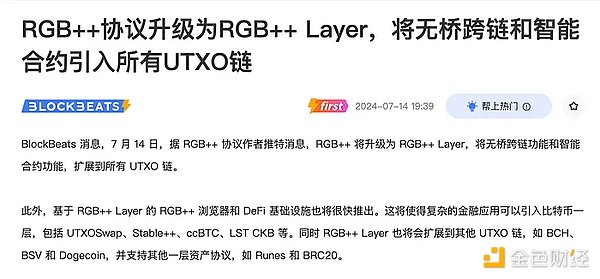

Recently, I saw on the media platform that CKB RGB++ will be upgraded to RGB++ Layer, extending the bridgeless cross-chain function and smart contract function to all UTXO chains.

What is the role of upgrading to RGB++ Layer?

(I) CKB RGB++ Layer is the UTXO smart contract layer

After the upgrade, CKB RGB++ Layer further abstracts and expands on the basis of ensuring the native security of Bitcoin and providing programmability, focusing on the isomorphic binding with the UTXO model, and is ready to be built into an independent and universal UTXO smart contract layer.

Does it feel like reading a book written in a foreign language? Actually, you can understand it this way:

CKB RGB++ Layer is a UTXO smart contract layer, just like Ethereum's smart contracts, data processing and L2 transactions will be aggregated here. When this level is reached, any UTXO chain in the future will use CKB RGB++ Layer as a smart contract layer, making BTC Layer2 more prosperous.

CKB RGB++ Layer has four important conditions for operation:

UTXO

Smart contract

POW

Account abstraction

On the RGB++ Layer, various RGB++ assets, such as Coin (FT) and DOB (NFT), are uniformly abstracted with Turing-complete programmability. At the same time, users only need to use their original BTC wallet to seamlessly use various DeFi applications on the RGB++ layer.

(II) RGB++ layer will gradually become the transaction layer of universal assets

In addition to the smart contract layer, RGB++ layer will also serve as the issuance layer of universal assets, realizing asset issuance based on smart contracts, so that any asset on the UTXO chain can seamlessly enter the RGB++ ecosystem.

Based on native UTXO + account abstraction, it can directly break the asset island, allowing various assets on chains such as BTC, CKB, BSV, BCH to obtain interoperability and achieve decentralized aggregation.

At the same time, RGB++ Layer has the parallel advantages of UTXO and the global state of account abstraction, allowing various DeFi protocols to obtain native and efficient implementation of the BTC ecosystem.

(III) RGB++ Layer will provide an independent blockchain browser

In this update of RGB++ Layer, the platform will provide an independent blockchain browser to view all assets and transactions on RGB++ Layer.

This function may seem insignificant, but we can understand that a powerful public chain will have its own supporting system, among which the retrieval system and DeFi system are the core of the public chain.

The existing centralized indexer has various hidden dangers. Currently, RGB++ Layer uses CKB as the indexer, which is safer than the centralized indexer and can call smart contracts, which enhances composability. RGB++ has become a standard specification, clarifying how to write remarks, combine, and use on each UTXO chain. RGB++ Layer provides unified management of status and interoperability. In the future, any chain can be used as its indexer based on meeting the four conditions of RGB++ Layer.

From such a low-level technology, that is to say, the goal of RGB++ Layer is to create a universal, cross-chain interoperable UTXO DeFi infrastructure and become a UTXO "financial port".

It may take less than a few months for the UTXO chain to take off. Through RGB++, LTC, DOGE, and BTC, you can issue coins and communicate with each other, with many ways to play.

V. RGB++ Layer Upgrade BTCFi Use Case

The first asset based on the RGB++ protocol, Seal, has been traded on UTXOSwap for some time. It is benchmarked against PIZZA. The current market value is relatively low, and not many people know about it. With the later empowerment and value discovery, it is not impossible to benchmark against Orid.

What is the IBO model

In this RGB++ Layer upgrade, the Seal community developed and operated the IBO (Initial Bitcoin Offering) tool platform, which will become the first IBO tool in the Bitcoin ecosystem and will become the launchpad for the entire RGB++ asset. Building a pool directly in UTXOSwap through smart contracts, as well as a series of other asset issuance and Defi gameplay are all based on smart contracts, which was not possible in the BTC ecosystem before.

Users who have played launchpad know that launchpad basically empowers platform coins, locks Seal and mines project tokens.

The IBO model is a new attempt. It is not like VC coins with low circulation, high valuation, and no community support, nor is it like Fair Launch with 100% circulation, lack of motivation for the project team, or no team, and no plan after issuance.

IBO attempts to use high circulation, low valuation, and community-led, empowering community holders from the beginning. The token model is between the VC model and the FL model.

It will be launched during the Bitcoin 2024 conference (7.25-7.27).

Summary

BTC Layer2 is a trillion-dollar market. Currently, there are 200 projects that have issued coins or are in operation. Many of these projects are working on EVM. Although the development threshold is low and the start is fast, it is easy to have a wave of flow. After the airdrop users mine, withdraw and sell, the project tends to die.

Therefore, many visionary project parties are trying on UTXO, and the most professional, longest-running, and most user-friendly UTXO is Nervos Network (CKB). After upgrading to RGB++ Layer this time, a universal, cross-chain interoperable UTXO DeFi infrastructure will be created, becoming the UTXO "Financial Port".

It may take less than a few months for the UTXO chain to take off. Through RGB++, LTC, DOGE, and BTC, you can issue coins, communicate with each other, and play in many ways.

JinseFinance

JinseFinance