a16z: How to distinguish between network tokens and company-backed tokens

Network tokens and company-backed tokens pose very different risks to holders and should be treated differently under applicable law. So, what is the difference?

JinseFinance

JinseFinance

Author: Charles Shen; Compiler: Sissi@TEDAO

Tokens are the basic building blocks of the Web3 world . The design quality of the token directly affects the success or failure of a crypto project. In this area, the key concept to measure the quality of token design is “Tokenomics”, which is a portmanteau of “Token” and “Economics”. A well-designed token economy can promote crypto projects to build a prosperous economic system and become an important driving force for the continued growth of the project's economic value. On the contrary, an improperly designed token economy may cause violent fluctuations in token prices and harm the long-term sustainable development of the project. Token economics play a fundamental role in the blockchain and crypto space, as important as distributed consensus and smart contracts.

However, token economics is a very challenging field for beginners. It involves more than just economic principles, and incorporates complex mechanisms from multiple disciplines including engineering, psychology, and behavioral science. This makes token economics a multi-dimensional, interdisciplinary concept that requires participants to have a broad knowledge background and in-depth understanding.

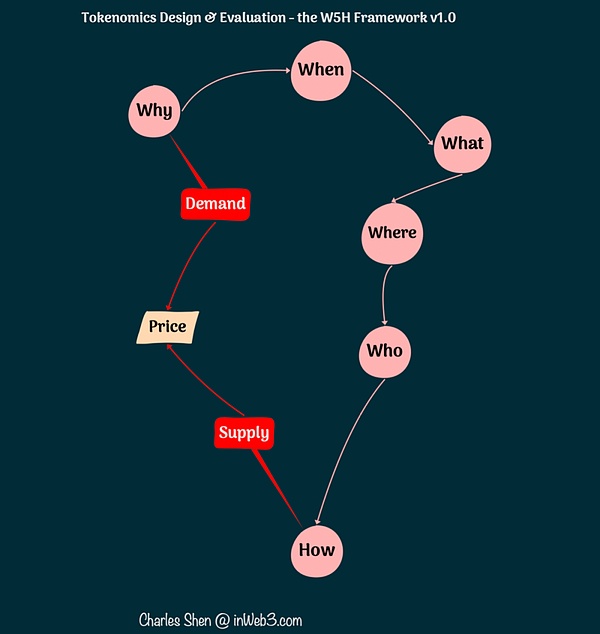

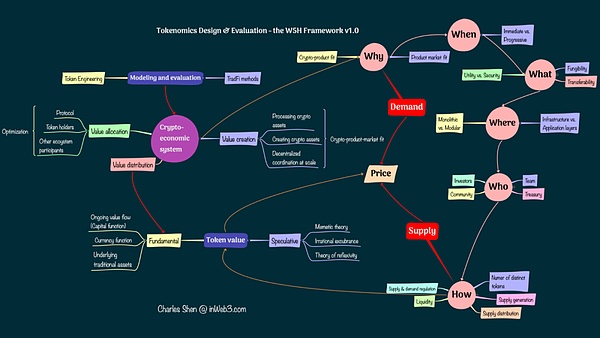

In this series of articles, a token design framework suitable for beginners will be introduced, briefly summarized as W5H (i.e. “Why, When, What, Where, Who and How"). The core ideas of the W5H framework are as follows:

"Why" explores the reason for the existence of tokens and whether the crypto-economy behind them can continue to create value;

" When" examines the best time to issue a token;

"What" examines which type of token is best suited for a specific purpose;

"Where" focuses on which blockchain network level the token should exist;

"Who" focuses on the ecology Which parties in the system are best suited to own tokens;

The "How" involves determining how many different tokens are needed, their generation, distribution, issuance and Liquidity provision and other topics.

In the crypto-economic system, as supply and demand continue to dynamically change, the W5H cycle is perfected. This balance of supply and demand has a direct impact on the price of goods and services throughout the economy, and even the value of the token itself.

When applying this framework, it is importantto start with a business perspective and consider various factors related to the token before delving deeper Characteristics specific to the token itself. As an important part of the crypto-economy, tokens’ value comes from the operation of the entire economic system.

Before exploring in depth, let’s briefly sort out several terms often mentioned in this series. Key terms: Token, Crypto, Crypto-economics and Tokenomics. Readers familiar with these terms may choose to skip this section. Newbies who want to learn more about related concepts can refer to the terminology explanation page or the series of introductions about blockchain, cryptocurrency, metaverse and Web3.

Tokens:Tokens usually symbolize some kind of economic or social value, such as coupons, movie tickets, or stocks. In the context of blockchain, we focus on “cryptotokens”, which are digital tokens created and managed through blockchain encryption technology.

Cryptocurrency: The word "Crypto" is often associated with cryptocurrency. However, it actually refers to the broader category of crypto tokens, whether or not they function as currencies.

Cryptoeconomics vs. Cryptoeconomics: Cryptocurrency projects often involve multiple token transactions that constitute the structure surrounding the project. economic basis. We call it “cryptoeconomics” and the research into it is called “cryptoeconomics”. Tokens, whether they come from within the system or from outside, may have an impact on the crypto economy. Cryptoeconomics is more suitable to be applied at the level of the entire project, rather than limited to a single token.

Token economy and token economics:Token economy is a concept closely related to the crypto economy. Although the two are sometimes used interchangeably, they actually have subtle differences. Token Economics and its field of study, Token Economics, are usually discussed with respect to specific tokens. Excellent token economics should be based on cryptoeconomics that can continuously create value. The converse is not necessarily true, as tokenomics also involves how the value created in the cryptoeconomy is allocated to specific tokens, a topic we will discuss in detail in part five of this series.

While token design is critical for token-based projects, not all crypto projects need to create their own tokens from the start to be successful. A wise token designer should first consider: "Why does the project need tokens in the early stages?"

Usually, when we discuss When asking this question, we are referring to native tokens that are specifically customized for the project, as distinguished from other external tokens that the project may involve. For example, Uniswap’s $UNI is the native token of its project, but Uniswap also handles many other non-native tokens.

When discussing the question "why tokens?", one possible answer is thattokens help projects raise funds. In addition, tokens have other advantages, such as giving early community members the opportunity to invest in the project and share the benefits of its growth. This is different from traditional early investment, which usually only allows those with specific certifications. Investor participation. But be aware that the potential earnings of an early-stage token project are not always certain, and there are legal uncertainties surrounding this approach. SoWhile fundraising is one reason, it shouldn’t be the only or core answer.

I tend to think of the "why coin" question as a cryptocurrency-product-market fit question, divided into Two steps to consider:Cryptocurrency andproduct, and product-market fit.

Cryptocurrency and product fit: Why integrate cryptocurrencies into your business model?

When we discuss it from the perspective of cryptocurrency adaptation, we can look at the problem from two complementary perspectives:One is encryption The role of currency in products, and the second is the economic areas in which cryptocurrencies may be integrated.

The role of cryptocurrencies in crypto product business models

Cryptocurrencies and the blockchain technology behind them rely on several core technical pivots that give them unique value:

Distributed consensus mechanism forms the basis for creating distributed ledgers, ensuring the immutability and transparency of transaction records.

The function of smart contract provides programmability and can realize any transaction including various types of transactions. business logic.

Tokenization is a digitalization that allows value to be transferred smoothly on a global distributed ledger Way.

Although different projects may utilize cryptocurrencies in their own unique ways, the above characteristics contribute to the three main cryptocurrencies Formation of product business model:

Type A: Handling external cryptocurrency assets ( existing tokens) without having to create your own.

Cryptocurrency exchanges are an example of this type. Coinbase is a centralized cryptocurrency exchange that does not require its own native token to operate. Uniswap is a decentralized cryptocurrency exchange deployed on the Ethereum blockchain and initially did not have its own token. Although the $UNI token was later introduced, the token was primarily used for governance and was not required for its core trading services.

Type B: Create new tokens by tokenizing various assets, and realize efficient transactions (such as transfer, transaction, verification, etc.) of these tokenized assets through the global distributed ledger. These assets can include financial assets, physical assets, and intangible assets.

In terms of financial assets, $USDC is an example that tokenizes the U.S. dollar and creates a stable cryptocurrency that can be used in the cryptocurrency world and many non-cryptocurrency venues for use.

On the physical asset side, some companies are working to tokenize real estate, agricultural commodities, and rare wines to make these industries more efficient.

In terms of intangible assets, BAYC (Bored Ape Yacht Club) NFT is a typical case, which provides holders with access to a unique social circle A ticket is equivalent to a club access voucher. Similarly, POAP (Proof of Attendance Protocol) NFTs are used to record the fact that people participate in specific activities and become a tool to build personal reputation.

Type C: Creating and leveraging tokens to enable large-scale decentralized autonomy cooperation. Tokens in this category typically have utility functionality and/or governance rights. These tokens are often used as incentives to direct the flow of value toward the ecosystem’s shared goals. There are several common product categories under this category: infrastructure, applications, and people-facing services.

The Bitcoin network is an example of an infrastructure product. It uses its $BTC to channel the value created by the network into a decentralized group of miners. This arrangement incentivizes miners to provide hashrate to maintain network security, which is critical to the functioning of the Bitcoin system. Other infrastructure examples include Ethereum using $ETH to coordinate its decentralized stakers to help secure the Ethereum blockchain; Filecoin utilizing $FIL to coordinate its decentralized providers to provide file storage services; Chainlink using the $LINK token To coordinate decentralized operators and provide off-chain data oracle services.

Many DeFi protocols fall into the application product category. For example, AAVE is a lending protocol that has a security module that rewards AAVE token holders for helping to secure the platform in the event of a deficit. In addition to the utility of participating in the security module, AAVE token holders have full governance rights and can decide to tweak and improve the protocol. This governance structure is commonly used in decentralized autonomous organizations (DAOs).

Examples of human-facing services include various types of DAOs. BitDAO is a multi-billion investment DAO whose BIT token holders vote to invest in the builders of the decentralized economy. DeveloperDAO is a SocialDAO formed by a community of Web3 developers and builders with the goal of engaging developers and building tools for Web3. It initially adopted an NFT-based one-person-one-vote system, and later switched to using interchangeable $CODE tokens to differentiate the voting rights of different levels of contributors.

In short, taking the above three types as a starting point and combining them with the specific circumstances of the project can help us sort out the application scope of cryptocurrency and the projects Do you need to create your own native token?

Cryptocurrency products facilitate the transactions needed to build a crypto economy. At the same time, the cryptoeconomy is also the result of integrating cryptocurrencies with our existing economic sectors, such as the real economy, the financial economy, and the physical or virtual economy. Therefore, another way to look at cryptocurrency and product fit is to analyze the relationship between cryptocurrencies and these different economic sectors.

Cryptoeconomics

The real economy involves the production and consumption of actual goods and services (such as food, clothing, real estate, machinery, etc.). It is influenced by both the demand side (people's demand for goods and services) and the supply side (the cost of producing those goods and services).

Financial economics deals with the trading of currencies and other financial assets. These financial assets are usually linked in some form to physical assets. For example, stocks represent an ownership interest in a real sector of the economy. Credit in the financial economy flows to the real economy, helping to increase its productivity.

Both the real economy and the financial economy can exist in the physical world or the virtual world. A notable example of a virtual world economy is a massively multiplayer online gaming platform that allows the trading of virtual goods and services.

The different types of economies can be summarized in the following table:

The real economy and the financial economy, whether physical or virtual, can be integrated with cryptocurrency . Cryptocurrencies are an important force driving the convergence of these different types of economies. The result of this process is a hybrid economic form that mixes physical and financial assets, existing in both the physical and virtual worlds, also known as the metaverse economy. Although there are already many activities in the field of virtual financial economy, in order to promote the development of the metaverse economy, more development is needed in the field of virtual real economy.

Now, let us explore more details of cryptocurrency in the financial economy and the real economy respectively.

Application of Cryptocurrency in Financial Economics

The earliest encryption projects were born for the financial economy. For example, Bitcoin, as the first and most important crypto project, deals with financial payment systems. There are several important topics at the intersection of cryptocurrency and financial economics:

Based on blockchain, creating a decentralized version of the financial economy in the crypto world. Many DeFi applications that have been launched so far fall into this category. For example, asset exchanges like Uniswap and Curve, and lending banking institutions like AAVE and Compound. Various stablecoins such as $DAI are also notable examples of this category.

Connect and integrate the new financial economy based on encryption with the traditional financial economy. For example, Synthetix is a crypto platform that enables real-world equity and commodity derivatives to be traded in the crypto space. The MakerDAO protocol provides Philadelphia-based Huntingdon Valley Bank with a $DAI commercial loan worth $100 million, marking "the first commercial lending collaboration between a U.S. regulated financial institution and a decentralized digital currency." BlockTower Credit partners with MakerDAO and Centrifuge to bring $220 million worth of physical assets to DeFi.

The application of cryptocurrency in the real economy

Cryptocurrencies may not be as directly connected to the real economy as they are to the financial economy. Part of the reason is that the real economy essentially deals with mostly physical, tangible parts of the real world, while cryptocurrencies are digital in nature. But there are still many possible use cases at the intersection of crypto and the real economy. The speed at which different industries integrate into the crypto space is expected to vary widely. We can get some clues from how the digital transformation process performs in different areas across different industries. According to a study by Harvard Business Review, the information and communications technology (ICT) sector is overall the most digitized industry, while agriculture and hunting are the least digitized. These results are not surprising, as the ICT industry itself is a driver of digitalization in all other industry sectors. Meanwhile, the farming and hunting industries rely largely on non-digital jobs. Based on these observations,we expect to see more mature real-economy encryption projects first in more digital industry sectors, particularly the ICT industry.

Similar to encryption applications in the financial economy, we have also seen two important themes in real economy projects:

< ul class=" list-paddingleft-2">Utilize cryptocurrency mechanisms to create a peer-to-peer version of the real economy business model. For example, in the ICT industry, Filcoin and Arweave are building decentralized file storage service networks; Helium is creating a point-to-point wireless communication network.

Integrate cryptocurrency mechanisms into existing real economy operations. For example, Brave, a browser released in 2016, launched $BAT in 2019 to support its advertising system.

Cryptocurrency-product fit is only one of the necessary conditions for the success of crypto products, but it is not sufficient. Another key test is whether it achieves product-market fit. Product-market fit requires a healthy and ongoing balance between supply and demand for a product, resulting in sustainable economic value creation.

A common signal of a lack of product-market fit can be drawn from the demand for the product. Helium is a high-profile crypto project with top-tier venture capital backing. The project is building a peer-to-peer Internet of Things (IoT) wireless network service based on token incentives. However, weak demand for its network has sparked fierce debate over whether it is a perfect real economic use case for crypto, faster and more capital efficient than traditional telecom infrastructure, or whether its cryptoeconomics simply don't work. In 2022, the team partners with T-Mobile to further offer 5G services, launch new tokens, and continue to find product-market fit. Another high-profile real economy use case is IBM’s partnership with Maersk to create a blockchain-based trading platform to streamline the supply chain industry. However, the project was shut down after failing to gain sufficient support within the industry.

Even if demand for cryptocurrencies is strong, the business models designed to meet that demand may not be sustainable. One lesson we can draw from the crypto economy is the Terra UST stablecoin project. This is one of the most well-known crypto projects in the industry, with financial support from many well-known VCs in the industry. The project has performed strongly in terms of market demand, with a market value of $30 billion at its peak. However, the project still collapsed due to fundamental flaws in its business model.

Proving or evaluating whether a project achieves product-market fit is not easy. One way to help explore this direction is by reviewing its financial data, such as a project's expenses, revenue, and profitability. Websites like tokenterminal provide information.

It is important to note that it is not uncommon for crypto projects to experience negative returns during their growth stages. Leading DeFi protocols such as Curve, Convex, and dYdX all operate at a loss incentivized by their token offerings. But they are also among the agreements that generate the most fees or revenue. Therefore, they try to attract users by providing subsidies to them. We often see similar tactics among non-crypto startups. Companies like Amazon and Tesla lost money for years during their early growth stages before turning a profit. Ultimately, the underlying soundness of the business model and/or the team's ability to adapt will determine the long-term success of the project.

Through the in-depth understanding of the market fit of encryption products Understanding, we can now go back to the original question of why a project needs tokens.

Recall that, more precisely, the question is about why a "native token" was created for the project? In fact, this question has already been answered when we discussed the role of tokens in the three basic crypto product business models, and can be summarized again as follows:

Type A crypto products are primarily focused on handling external tokens and do not require their own tokens for their core operations. However, they may choose to introduce tokens for other purposes, depending on the situation. For example, the Uniswap crypto exchange does not require tokens to operate, but it introduced the $UNI token for governance. This also makes it a hybrid Type A and Type C business model.

Type B crypto products by definition need to create their own native token. For example, if we issue a new fiat-backed stablecoin by tokenizing fiat assets, then this stablecoin is a required token because it is the product in itself.

For type C encryption products, if its tokens provide essential practical functions for the product, such as for maintenance Incentive tokens for infrastructure security (such as $ETH for the Ethereum blockchain and $BTC for the Bitcoin blockchain) then it is required. If the tokens are used for other purposes, such as governance, then the answer may be "maybe" as many applications or human-facing services may be launched without the tokens. But when they are ready to decentralize, they can subsequently launch the token. We will elaborate on this in a subsequent “When to introduce tokens” discussion.

This article examines the “Why do we need a token?” question that token designers need to consider before launching a token. The starting point for answering this question is to examine the underlying business model associated with the potential token, specifically “crypto product market fit.” We first explored crypto product adaptability by examining the role of cryptocurrencies in products and the integration of cryptocurrencies into different economic sectors. We then discussed product-market fit to ensure the product continues to create economic value. Finally, we summarize our rules of thumb on whether common crypto product business models require tokens.

"Why do we need tokens" is the first "W" in the "W5H" framework of thinking, we will explore the remaining "W" in the next article W".

Network tokens and company-backed tokens pose very different risks to holders and should be treated differently under applicable law. So, what is the difference?

JinseFinance

JinseFinanceSonic Network, white paper, quick look Sonic white paper highlights: ecological incentives, technical features, new token economy Golden Finance, interpretation of Sonic white paper.

JinseFinance

JinseFinanceTechnically, it is similar to the PoS version of merged mining; economically, it is a clever form of on-chain rent-seeking; commercially, it acts as a token distribution arbitrage game.

JinseFinance

JinseFinanceThe relationship between ORDI and all the subsequent inscriptions, runes and other tokens is like the relationship between Bitcoin and the subsequent cryptocurrencies.

JinseFinance

JinseFinanceOn June 26, 2024, Blast announced its token economics. The total supply of BLAST is 100 billion, 50% of which will be airdropped to the community, with an initial airdrop of 17 billion. Golden Finance has compiled detailed information on Blast's token economics for readers.

JinseFinance

JinseFinanceArbitrum is the second-layer network (L2) of Ethereum that is as famous as Optimism. It is the leader of the second-layer network and a representative of the optimistic Rollup technology school.

JinseFinance

JinseFinanceDecentralized finance tokens provide crypto users with access to a number of bank-like services such as loans, lending and insurance.

Coindesk

CoindeskCoinlive speaks with the Game Partnership Lead of Klaytn to find out more about the dangers of the Metaverse in an exclusive interview.

Darren

Darren Coinlive

Coinlive Token Burning is simply removing or destroying a reasonable amount of a project’s total supply.

Nulltx

Nulltx