Author: Gabe Parker, Galaxy; Compiler: Songxue, Golden Finance

Abstract:

NFT trading activity on Solana resumed 2.6 times faster than Ethereum.

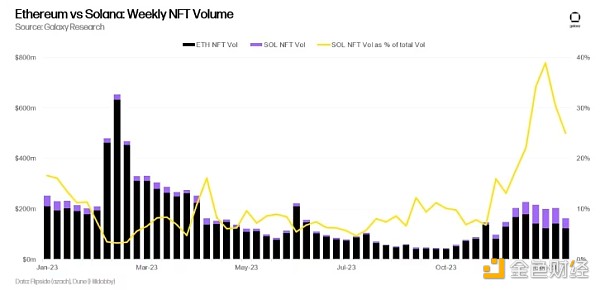

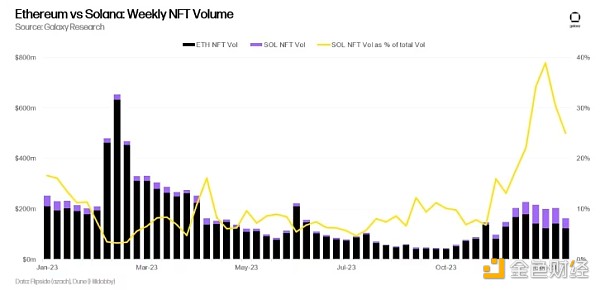

In 2023, Ethereum contributed more than 90% of weekly NFT trading volume 67% of the time.

As of January 8, 2024, Solana’s weekly NFT trading volume accounted for 25% of the total NFT trading volume.

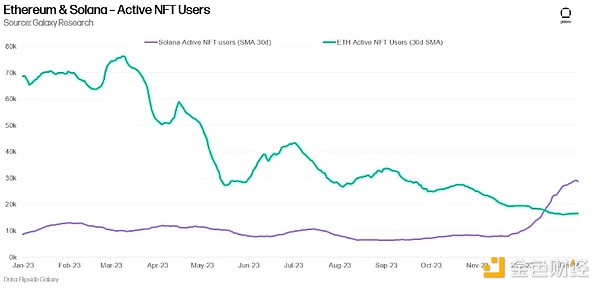

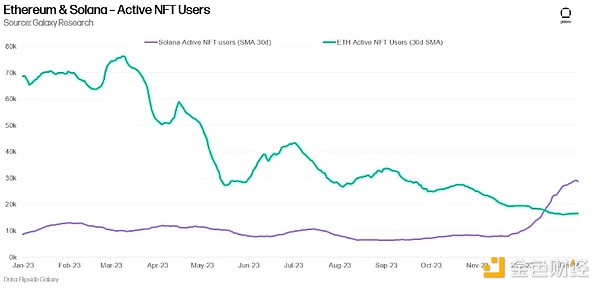

In 2023, the number of active Ethereum NFT users dropped by 73%, while Solana’s number of active NFT users increased by more than 80%. NFT users are unique addresses that mint, buy, sell or transfer NFTs within a single day.

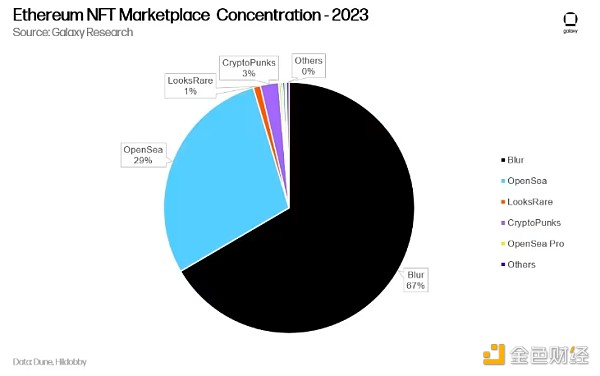

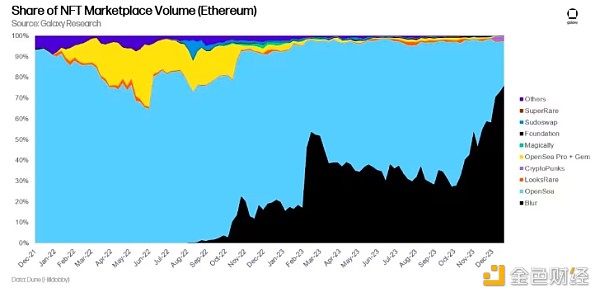

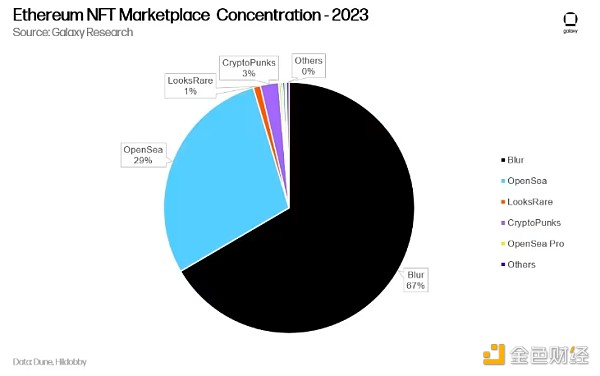

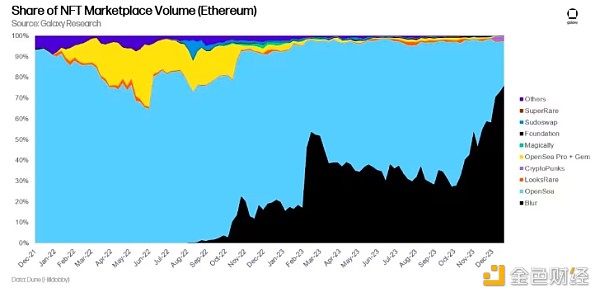

The NFT market concentration has changed significantly in 2023 with the increasing popularity of advanced NFT trading platform Blur. Unlike incumbents such as OpenSea, Blur relies heavily on incentive programs such as token airdrops to attract users.

In 2023, Blur accounted for 67% of the total Ethereum NFT transaction volume. Prior to the launch of Blur, OpenSea had more than 80% share of NFT transaction volume, but only accounted for 29% of total Ethereum NFT transaction volume that same year.

Foreword

In the fourth quarter of 2023 , the NFT market has seen a clear recovery. As of January 16, 2024, Ethereum NFT trading volume has increased 4x, while Solana NFT trading volume has increased more than 10x since its 2023 nadir. As NFT trading volume recovers from all-time lows, the floor prices of the top NFT projects on Ethereum and Solana are also rising. This research report will highlight the resurgence of NFTs in Solana and the Ethereum ecosystem and provide predictions for their growth through 2024. This report will also analyze the characteristics of incentive-driven NFT markets like Blur and Tensor, which have been taking significant market share from traditional NFT markets such as OpenSea.

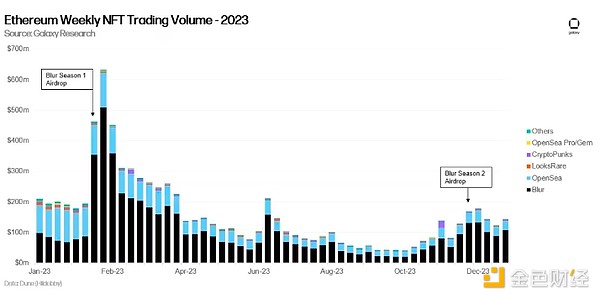

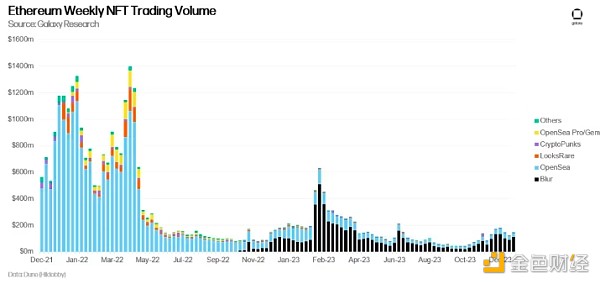

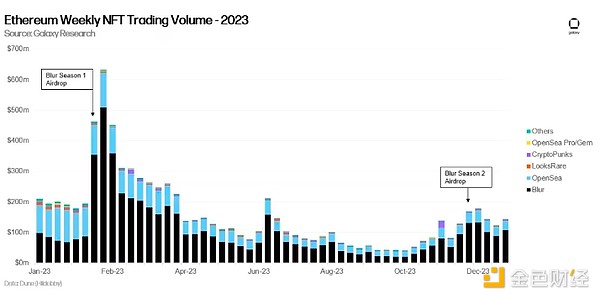

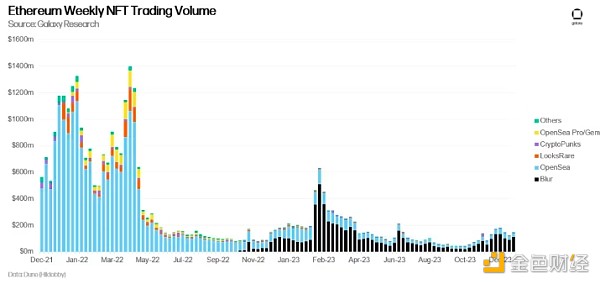

Ethereum NFT Market

Ethereum NFT trading volume bottomed out in September 2023, with the lowest trading volume in that month being $143 million. The situation was particularly severe from October 9 to October 16, 2023, when Ethereum NFT trading volume plummeted to just $40 million. However, since October 9, 2023, there has been a significant reversal, and Ethereum NFT weekly trading volume has surged by an astonishing 380%. This sharp rise is mainly attributed to Blur’s second season airdrop on November 20, 2023. Blur uses $BLUR tokens to incentivize users to bid, place orders and lend NFTs on its platform. It is worth noting that NFT traders are actively involved in trading weeks before such airdrops occur, a trend that was also reflected in Blur’s first quarter airdrop on February 14, 2023. In addition, airdrops have created a wealth effect, prompting NFT traders to reinvest airdrop funds into NFTs to maintain their points-earning activities.

Although Ethereum’s Weekly NFT trading volume has increased by 380% from the lowest point in 2023, but is still down 89% compared to the peak (last seen in March 2022). Ethereum’s NFT market still faces a long road to recovery. Entering 2024, the next round of recovery of the Ethereum NFT ecosystem may be driven by advanced NFT trading platforms like Blur and Blast. Incentivize trading activity through airdrops.

OpenSea launched its professional trading platform in April 2023 to compete with Blur; however, since September 2023, OpenSea Pro has only accounted for 9% of Ethereum NFT trading volume. In the field of professional NFT trading, Blur’s dominance remains, mainly due to its first-mover advantage and user experience/UI design. For example, the order book system employed by Blur allows NFT traders to better assess the depth of a project’s price floor than any other market. Coupled with Blur’s native NFT lending platform Blend, it provides NFT traders with the tools to build complex trading strategies.

Looking forward to 2024, Blur’s position will be strengthened by the third quarter airdrop planned for May 2024. The event is expected to further incentivize NFT traders who have used Blur before, as 50% of the next airdrop will be distributed to existing $BLUR token holders. Blur's strategic advantages extend beyond its first-mover status to the comprehensive ecosystem it has established.

Blur’s positive attitude towards token economics is reflected in its recent governance proposals. The proposal advocates that the community activate a fee switch to introduce a 1% market fee incurred at the time of purchase, and proposes that the proceeds be used to buy back and destroy $BLUR tokens, thereby reducing the supply of $BLUR. While this governance proposal is currently awaiting approval, it demonstrates Blur’s continued focus on optimizing platform tokenomics to occupy a significant position in the growing NFT market space.

While the recent surge in NFT trading volume has been attributed to crypto-native users re-engaging in NFT markets such as Blur, There are a large number of NFT traders staying on the sidelines. Notably, OpenSea’s weekly trader count is up from its all-time high in January 2022 It fell by 86%, indicating that there are still a large number of retail investors who have not yet re-entered the market. Although Blur is the most popular NFT marketplace among the cryptocurrency community, it primarily caters to a more established, affluent group of NFT traders. Against this backdrop, monitoring OpenSea’s volume share is critical to gauging the resurgence of retail interest in NFTs.

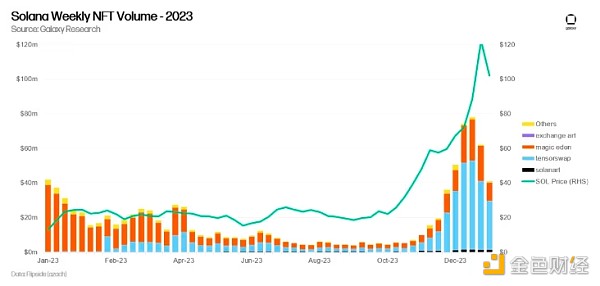

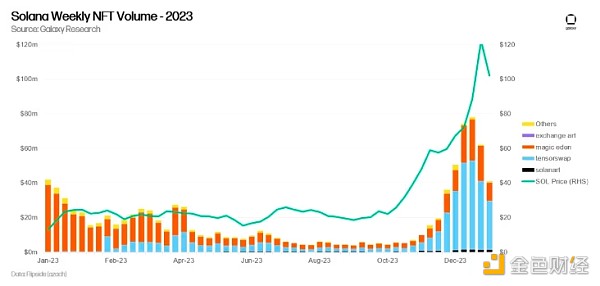

Solana NFT Market

Solana’s NFT trading volume also bottomed out in September 2023, with transactions that month The amount is US$30 million. From October 9 to October 16, 2023, Solana NFT had the lowest trading volume, generating only $4.3 million in trading volume. Since October 16, 2023, Solana’s NFT weekly trading volume has increased more than 10 times. The significant increase in Solana NFT’s weekly trading volume can be attributed to two main factors:

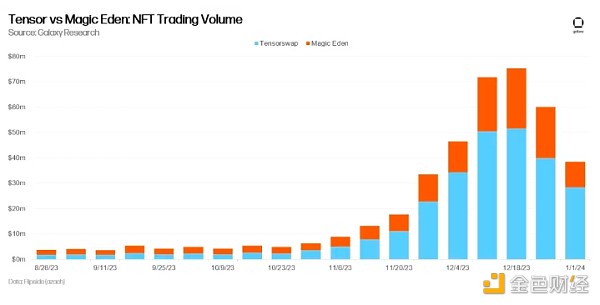

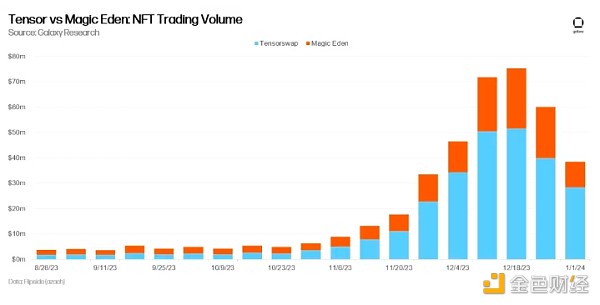

Tensor is Solana’s version of Blur, launched in 2022, and allows NFT traders to develop complex trading strategies. Tensor’s second airdrop ends in August 2023, and their next airdrop is expected to occur around January 2024, so Solana NFT collectors are increasing trading activity to earn points. The more critical impact driving Solana’s NFT ecosystem is the wealth effect that Solana holders are experiencing. With SOL rising 615% in 2023 and generous airdrops from other Solana apps being distributed to the community, Solana activity has increased across various app types, including NFTs.

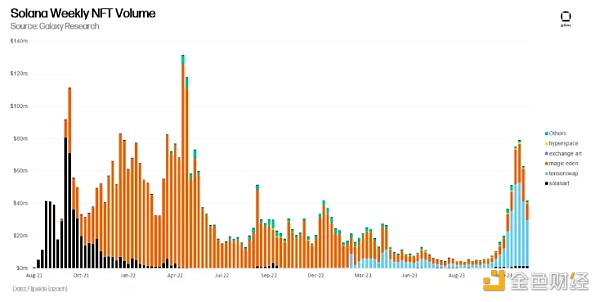

Although Solana’s NFT ecosystem has recovered faster than Ethereum, weekly Solana NFT transaction volume is still down more than 60% from its peak in May 2022. Similar to Ethereum, Solana has a strong NFT ecosystem that provides a cost-effective and user-friendly experience for trading NFTs. Additionally, Solana’s NFT infrastructure is maturing rapidly, and wallets and other NFT applications are introducing the ability to display NFTs alongside exchangeable token holdings to better support the digital collectibles ecosystem. growth of. Overall, Solana’s next NFT market cycle, like Ethereum’s, will likely be driven by trading activity on advanced trading platforms such as Tensor.

Market Concentration< /h2>

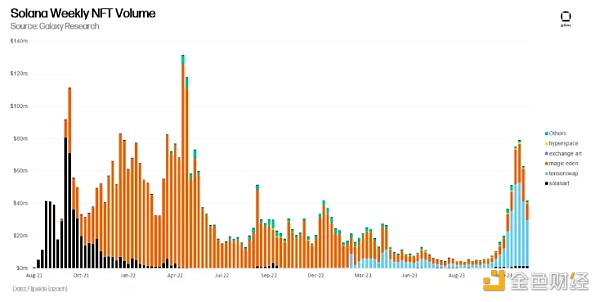

Advanced trading platforms like Blur and Tensor have grown rapidly, dominating a significant proportion of NFT trading volume on their respective chains. Concentration in the NFT market is a mutually beneficial outcome for active NFT traders who rely on ample liquidity to enter and exit extremely volatile assets. Blur and Tensor incentivize users to provide liquidity to their markets by rewarding users for placing bids on their markets, and sellers can use these auctions to understand the market depth of a specific NFT. Before Blur and Tensor, traditional NFT marketplaces like OpenSea used a quoting system without incentives. The lack of incentives for buyers to submit competing offers has resulted in scattered offers that are significantly lower than the NFT’s asking price.

In 2023, Blur accounted for 67% of the total NFT transaction volume on Ethereum. OpenSea, which dominated more than 80% of NFT trading volume before Blur launched, only accounts for 29% of total Ethereum NFT trading volume.

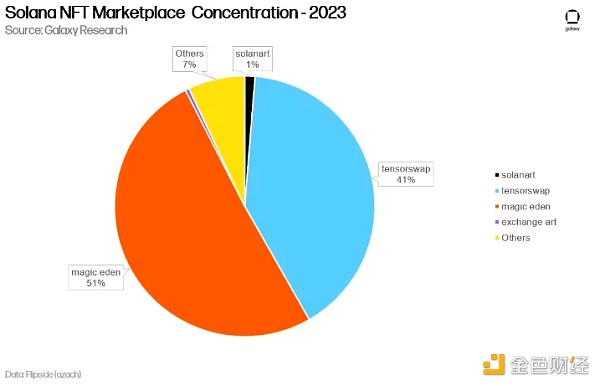

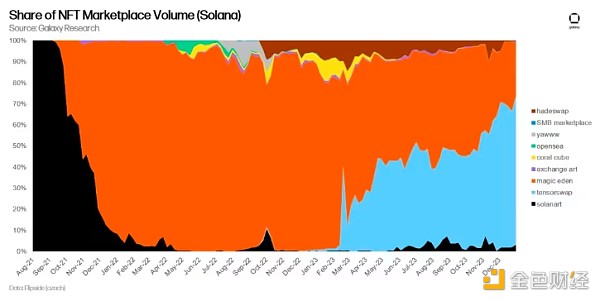

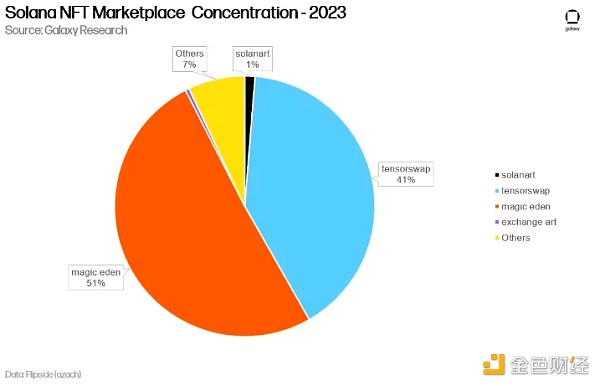

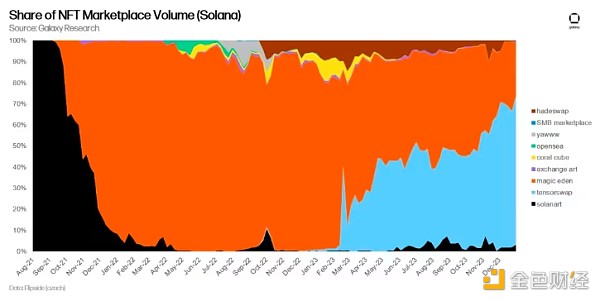

In 2023, Magic Eden dominates Solana’s NFT trading market, accounting for a staggering 51% of the total trading volume. However, taking second place was Tensor, which accounted for 41% of Solana NFT trading volume during the same year.

Although Magic Eden is ahead of Tensor in 2023, but on some days this year, especially during the NFT market recovery in October 2023, Tensor’s transaction volume exceeded Magic Eden. From October 1, 2023 to January 1, 2024, Tensor is significantly ahead, with 50% more transaction volume than Magic Eden.

Tensor is expected to be launched in 2024 Overtaking Magic Eden to become the NFT market share leader, as the advanced trading platform prepares for its Q3 airdrop as well as other incentive-driven initiatives to attract liquidity.

The impact of Blur and Tensor on NFT market concentration shows that advanced trading platforms are finding clear product-market fit. Although Blur and Tensor were platforms launched during a bear market, these platforms successfully gained market share from well-known traditional markets such as OpenSea and Magic Eden.

Ethereum vs Solana: Weekly NFT transaction volume and active users h2>

In 2023, Ethereum dominated the NFT space, accounting for more than 90% of the total weekly NFT transaction volume for 60% of the year. This metric excludes the trading volume of Ordinals and BRC-20 on Bitcoin. Notably, Ordinals and BRC-20 generated $1.8 billion in transaction volume in 2023, making Bitcoin the second most popular network for digital collectibles during this period.

Solana NFT faces fierce competition from Ethereum NFT for market dominance between May and September 2023. During this period, Solana NFT trading volume accounted for less than 10% of overall NFT trading volume. However, Solana NFT finally found an opportunity for development in November 2023, and has rapidly gained NFT transaction volume market share since then. By December 2023, weekly Solana NFT trading volume will account for at least 22% to 37% of total NFT trading volume.

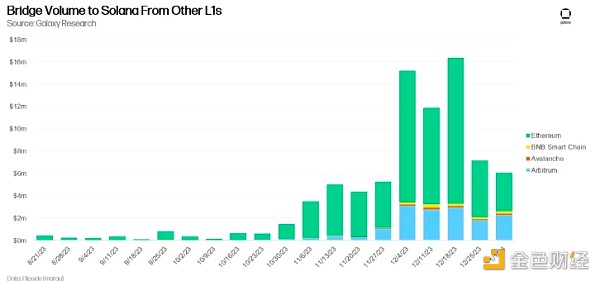

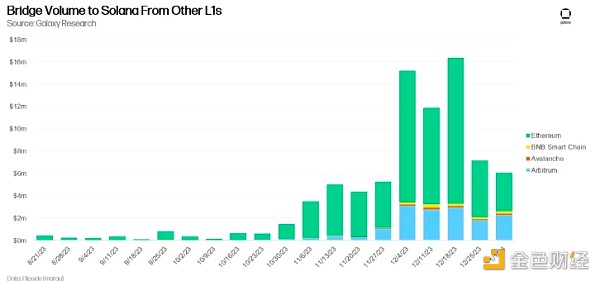

Solana’s NFT transaction volume will continue to compete with Ethereum’s NFT transaction volume in 2024. Since December 1, 2023, $50.5 million in funds has been transferred to Solana from other blockchains, including Avalanche, BNB Smart Chain, Arbitrum, and Ethereum. While new capital flowing into Solana may be driven by airdrops and yields provided by the Solana decentralized finance (DeFi) application, which may quickly exit the ecosystem when incentives change, we can expect a portion of new capital to flow into Solana. NFT market. Based on new capital inflows through December 2023, depending on how quickly Ethereum NFTs recover,Solana’s NFT trading volume could rise by 2024 It accounts for 30%-50% of the total NFT transaction volume annually.

Observing the on-chain activity of wallets buying, selling, or minting NFTs on a single date, it is clearThe Ethereum NFT market Lack of new users. In 2023, the number of active Ethereum NFT users fell by 73%, while at the same time, Solana’s number of active NFT users has increased by more than 200%. Solana’s number of active NFT users rose sharply on December 19, 2023, causing it to exceed the number of active NFT users on Ethereum. Applying the number of active NFT users for Ethereum and Solana to the 30-day moving average, we can see that Solana now has more daily active NFT users than Ethereum.

As in the picture above One caveat to the data shown, active NFT users are defined as unique addresses that have minted, purchased, sold, or transferred NFTs within a single date. Unique addresses may be owned by a single individual or entity, and there may be more on Solana since the cost of transactions on the Solana network is cheaper than on Ethereum.

Summary

The upcoming NFT cycle is expected to be dominated by advanced NFT transactions platform, new airdrop incentives for NFT holders, and a wealth effect driven by the recovery of the broader crypto market. Advanced NFT trading platforms have solidified their position in the market with their Market dominance will continue to fluctuate in the 50%-60% range as liquidity will be concentrated on such platforms. Overall, as Solana’s NFT ecosystem undergoes its first re-pricing, the most promising prospects for 2024 One of the interesting developments will be the repricing of NFTs on Ethereum, especially if the ETH price also increases significantly.

JinseFinance

JinseFinance