Author: Alex Thorn, Director of Galaxy Research; Compiled by: Luffy, Foresight News

This is a New York City On a foggy morning, some of us were overwhelmed by yesterday’s crypto market storm (Translator’s Note: The original article was published on March 6th. The market storm refers to the fact that Bitcoin fell sharply by more than 10% after breaking through the all-time high of $69,000. $10,000) and feel overwhelmed. This morning I had some new thoughts on the Bitcoin revolution and intrinsic value. But before we get to that, let’s cut through the fog and talk about what happened in the crypto market yesterday and what it means for the bull market.

On March 5, the price of Bitcoin on Coinbase reached $69,324, refreshing the all-time high set on November 10, 2021. Subsequently, Bitcoin experienced a fluctuation of $10,000 and is currently trading back to $67,000. Yes, after 846 days, Bitcoin is back. Both physical and digital gold hit all-time highs. This is the first time that BTC and XAU (spot gold) have hit all-time highs at the same time, but it won’t be the last.

But Bitcoin is still not suitable for newbies. Immediately after hitting a new all-time high, Bitcoin plummeted 14.3%, falling to an intraday low of $59,224, and the futures market experienced both long and short explosions. Adding to the pullback, $400 million in Bitcoin longs were liquidated between 2pm and 3pm ET alone. Over the past 24 hours (as of 7 a.m. ET on Wednesday, March 6), long liquidations on cryptocurrency futures exchanges exceeded $800 million (if short liquidations are included, the total exceeds $1 billion).

Anyway, all this is yesterday and a thing of the past, because now Bitcoin is trading back at $67,000, which is actually That’s $4,000 higher than Bitcoin’s opening price on Monday morning. Volatility is back, and is likely to persist as we get past the “Wall of Worry.”

Translator's Note: The metaphor "Wall of Worry" comes from a widely circulated proverb on Wall Street. It refers to something other than It is not a single recession, inflation, politics or geopolitical issue that triggers investor panic, but a combination of all of the above.

Some background on the last breakout of all-time highs: Bitcoin’s journey has not been easy. In 2020, after Bitcoin first hit its previous ATH of around $20,000 on December 17, 2017, it took 16 days to finally break out. In fact, after hitting those highs twice, Bitcoin was trading down as much as 12.33%, before, of course, rebounding higher.

From the perspective of psychological and technical analysis, it is completely reasonable that the previous historical high is an important resistance level. Specifically, my mom told me that she sold some Bitcoin yesterday for $68,850. I don't know how she managed to sell at exactly the high point, she must not be a diamond hand fanatic like me. No matter what, I couldn't give up my chips.

But some old coins that had been dormant for years did wake up yesterday, and their sell-off may have led to intraday tops. On-chain data indicates that a large amount of Bitcoin mined in 2010 was transferred on-chain yesterday, and we assume that these Bitcoins were sold. Everyone has a psychological price, and if this was the same person and they did sell Bitcoin, they would probably want to sell at the 2021 highs and get out. I guess you could be a diamond player for 14 years and then discover your holdings To The Moon. All Bitcoin bull markets are characterized by old users transferring coins to new users, which is why Bitcoin holders become more and more massive. (I should point out that this holder could easily consolidate their mined Bitcoins into a new escrow wallet, at least I haven’t seen any on-chain indication that these Bitcoins were being sent to a crypto exchange .)

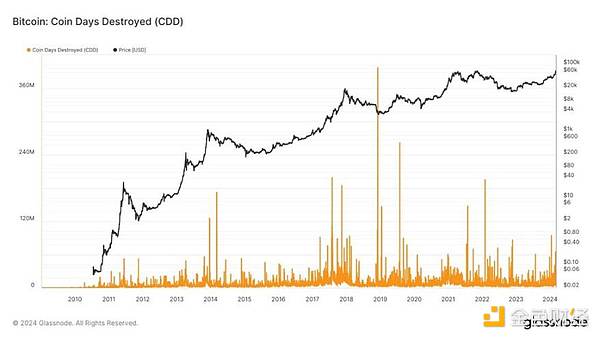

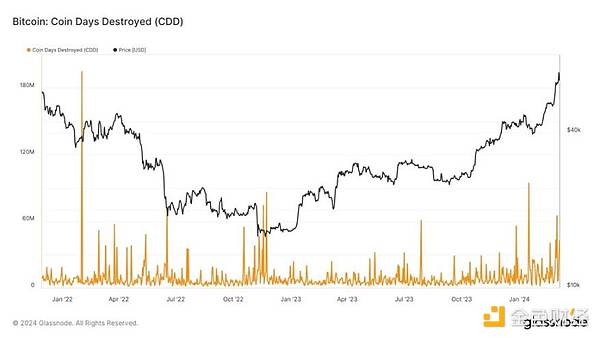

In fact, if we look at the Coin Days Destroyed (CDD) indicator, we can see that movements in dormant Bitcoin often mark bull market peaks or bear market bottoms. This metric takes the number of coins in a transaction (or all transactions on a given date) and multiplies the number of coins by the number of days since those coins were last transferred. For example, if I buy 1 Bitcoin today, put it into a cold wallet, and then eventually move it on-chain 300 days later, my transaction contributes 300 to the CDD metric. As Bitcoin prices moved higher over the past few weeks, we could see some higher CDD values.

By the way, some of these spikes, such as the one in early 2022, were due to extraordinary circumstances (the peak in early 2022 was due to the US government's seizure of $3.6 billion from Bitfinex hackers early on February 22 Bitcoin). When the Fed seizes these Bitcoins and moves them to wallets they control, it causes disruptions to the CCD indicator. Having said that, we are not seeing a flood of dormant Bitcoins flooding into the market – it looks like the market needs to go higher in order to get rid of OG.

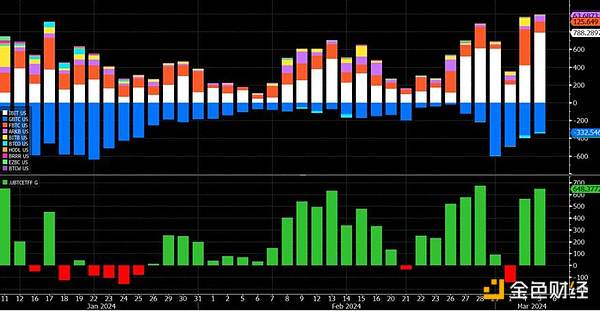

Yesterday, the daily trading volume of the Bitcoin ETF hit a record high, exceeding $10 billion. It was the Bitcoin ETF’s largest day of ever inflows and the second-largest day of net inflows since listing (net inflows of $648 million). The net inflow of Bitcoin exceeded 10,000 (more than 10 times the daily Bitcoin production of approximately 950 BTC). The growth rate of ETFs is truly astounding. As I wrote last week, capital inflows are not only continuing, they appear to be accelerating. This momentum cannot and will not stop.

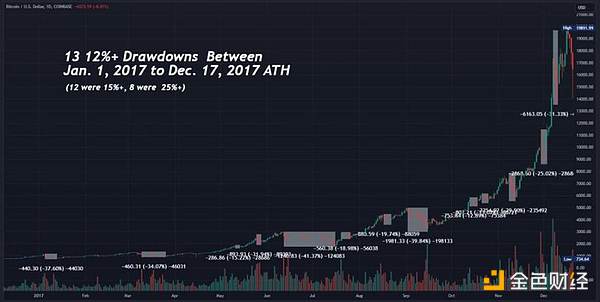

There is no doubt that as the bull market continues, we will climb the "Wall of Worry." Bull markets are non-linear and filled with numerous corrective moves. According to my statistics, from January 1, 2017 to the historical high of about $20,000 on December 17, 2017, Bitcoin experienced 13 declines of more than 12% (12 of which fell by more than 15%, 8 of which fell more than 25%).

The same story happened again in 2020. From the price low during the COVID-19 epidemic ($3858) on March 12, 2020 to $64,899 on April 14, 2021, Bitcoin had 13 retracements of more than 10% (7 of which retracements exceeded 15%) .

So, yesterday's price action doesn't make me think that Bitcoin won't go higher again. Although my readers won’t be surprised that I think Bitcoin will go higher. We’re exposing our new friends who hold Bitcoin ETFs to the fire of Bitcoin volatility. This is just the “Dalai Lama” price model (it’s an old meme, but it works).

For entertainment purposes, I debated the intrinsic value of Bitcoin yesterday with the same person. I know, this is not an efficient use of time. Satoshi Nakamoto once wrote: "If you don't believe me or don't understand, I'm sorry, I don't have time to try to convince you." Well, I do have time. This person believes that the U.S. dollar has intrinsic value because it is backed by the "full faith and credit" of the U.S. government, which I find hilarious, not because the U.S. dollar is not backed by the U.S. government's "full faith and credit," or something like that Credit has no value or will not have value in the future. I can make these arguments. But in my opinion, having something with intrinsic value means it can be consumed. Oil can be burned to power engines, corn can be eaten, and even gold can be made into decorative jewelry (which I guess is technically important).

Thus, I believe the dollar has no intrinsic value unless you plan to burn your banknotes to keep your body warm. It’s true that monetary instruments don’t need to have intrinsic value, and I don’t think any fiat currency in today’s world has any intrinsic value. In fact, it might be better for money to have no such thing as intrinsic value. After all, money is a tool that we can use to store the fruits of our labor to be traded across space and time, rather than needing to transfer our physical labor or possessions every time we want to transfer wealth. Why hamper this tool with a bunch of other use cases that might just reduce the usefulness of the tool. Bitcoin just takes this concept to the extreme, almost as if Satoshi Nakamoto thought “What if we could have all the properties of fiat currency without any of its drawbacks?” What if we could have a fungible, What about an easily transferable, divisible global currency, except that it is weightless, not issued by any central bank, and (incidentally) has a mathematically fixed supply?

This person was not prepared to accept this argument. He retorted to me and said, "What you are saying is crazy. This is not how the world works." Those in power—elites, entrenched middlemen, etc.—want you to believe that the world is rigid, systems are secure, institutions are permanent, everything is clear, and nothing has changed. Turmoil from the past? We solved the problem. Haven't you read the textbook? You can't have some novel solution that no one in the past 5,000 years of civilization has thought of. Reinventing money? We solved this problem in November 1910 on Jekyll Island. These ideas are stupid.

The world is much more complex and much older than people realize. Revolutions are destructive precisely because they overthrow the existing order, but revolutions are textbook content. If revolutions did not overturn established systems and ways of thinking, there would be no revolutions in our textbooks. So, nothing is clear yet. Human progress, like the Bitcoin chart, is non-linear. As we search for the light, we jump around intermittently, questioning ourselves and our previous assumptions. (Speaking of which, check out this hilarious chart I saw this morning – it’s a shitcoin). Innovation requires discarding or at least evolving past ideas. The more things change, the more they stay the same, but things do change.

Friends, please fasten your seat belts, our journey has just begun. Have faith, keep your Bitcoins in your own wallet if you can, and enjoy the greatest game ever on the market.

JinseFinance

JinseFinance

JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance Sanya

Sanya JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance Nulltx

Nulltx Bitcoinist

Bitcoinist