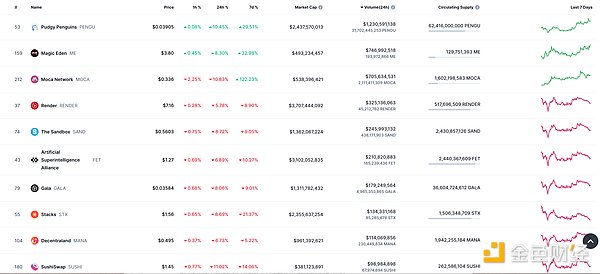

DeFi data

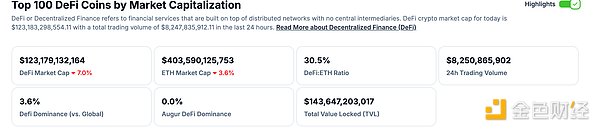

1. Total market value of DeFi tokens: US$123.179 billion

DeFi total market value data source: coingecko

< 2. The transaction volume of decentralized exchanges in the past 24 hours was 8.25 billion US dollars. .cn/7337302_watermarknone.png" title="7337302" alt="sHlPQODuwpoYHI7PYTh1n9oX7VEk7Cid43i1obvI.png">

Trading volume of decentralized exchanges in the past 24 hours Source: coingecko< /p>

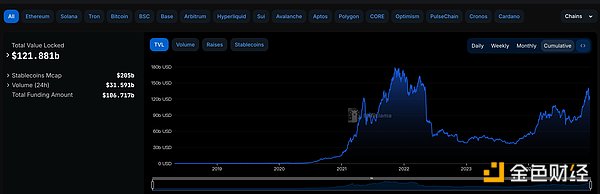

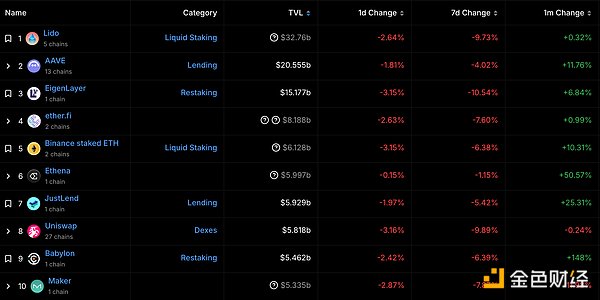

3. Assets locked in DeFi: 121.881 billion US dollars

The top ten rankings of DeFi projects’ locked assets and locked-in volume data source: defillama

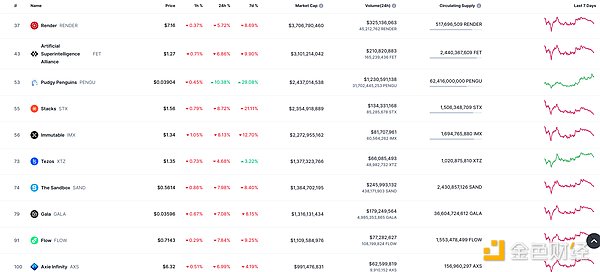

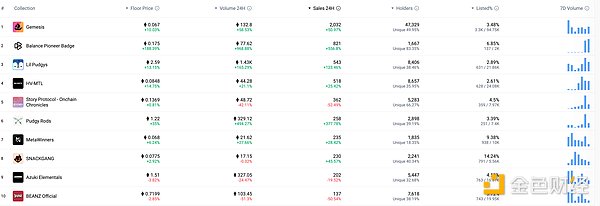

NFT data

1. NFT total market value: 38.38 billion US dollars

NFT total market value, market value ranking of the top ten projects data source: Coinmarketcap

2.24-hour NFT trading volume: 5.913 billionUSD

NFT total market value, market value ranking of the top ten projects data source: Coinmarketcap

3. Top NFTs within 24 hours

< /p>

< /p>

The top ten NFTs with the highest sales growth in 24 hours. Data source: NFTGO

Headlines

Eliza will announce a new token economics proposal and support native TEE in the future

According to ai16z community member 0xwitchy, ai16z revealed at today's community exchange meeting:

It has acquired a Launchpad company and is studying the structure of the liquidity pool;

ElizaOS v2 will use Coinbase Agent suite for compilation;

In the future, native TEE will be supported, all Eliza will have native TEE, and the agent can run in TEE;

The team will work with PhalaNetwork to solve the centralized TEE problem and try to form a decentralized TEE in which servers are distributed in different

Plug-in registration will be supported;

ElizaOS v2 will support fully automatic cross-platform anonymous messaging, for example, your agent will automatically post on Telegram after posting on Discord;

Eliza will release a new version around January 1 Coineconomics Proposal.

NFT Hot topics

1.Animoca Brands: No tokens or NFTs have been released, Yat Siu related posts were initiated by hackers

Golden Finance reported that Animoca Brands tweeted that Animoca Brands has not officially released tokens or NFTs. Yat Siu’s post claimed that the token release on Solana was initiated by hackers. Please do not Use this account and be vigilant.

DeFi Hotspots

1.Sky: USDS supply on Solana chain exceeds 100 million

2.Dora Factory launches decentralized public opinion survey based on MACI technology Infrastructure

On December 26, Dora Factory officially launched an innovative The public opinion survey product aims to provide a more transparent, fair and secure voting and public opinion expression channel for decision-making and discussion on hot topics in major communities. This product is not only another breakthrough of Dora Factory in the field of decentralized governance, It is also an important part of its construction of a new decentralized media product matrix. The product has initially realized support for Dora Vota and Cosmos Hub networks, and will be expanded to more mainstream public chain ecosystems in the future. It is widely used by communities such as Cosmos, Celestia, Aptos, and Injective.

3.UTXO Stack will launch a Lightning Network liquidity incentive program in 2025

Golden Finance reported that the modular BTC L2 blockchain startup platform UTXO Stack officially released the white paper "The Decentralized Liquidity Staking Layer for Hybrid Lightning Network" , and launched the 2025 roadmap and new official website. The white paper elaborates on UTXO Stack as the Lightning Network liquidity pledge layer, combined with Hybrid Lightning Network (Hybrid LN), Decentralized Liquidity Pledge (DLSP), Swap Node, Wallet and SDK and other core components work together to solve the key problems currently faced by the Lightning Network, such as insufficient liquidity, high entry barriers, and lack of stablecoin support. By integrating the Lightning Network with Nervos CKB's Fiber Network, UTXO Stack is committed to creating an efficient and scalable payment network, promoting the popularization and large-scale adoption of Bitcoin payments.

4. The total net deposits of Aave and Lido exceeded US$70 billion for the first time, accounting for 45.5% of the total deposits of the top 20 DeFi applications

Golden Finance reported that according to TokenTerminal data, the total net deposits of lending protocol Aave and liquidity pledge protocol Lido exceeded US$70 billion for the first time in December (currently falling back to US$67.37 billion). USD). Among them, Aave ranked first with $34.3 billion, followed by Lido with $33.1 billion. The two protocols together accounted for 45.5% of the total deposits of the top 20 DeFi applications. In terms of locked value (TVL), Lido Leading the DeFi ecosystem with $33.8 billion, Aave ranks second with $20.6 billion. In the past 30 days, Aave's revenue increased by 27.5% to $12.5 million, and Lido's revenue increased by 24% to $9.6 million. In 2024, the total locked amount of DeFi has increased by 107% to $185 billion, and on December 16, it once exceeded $212 billion.

5.USDC Treasury minted 50 million USDC on the Ethereum chain

Golden Finance reported that according to the on-chain data tracking service Whale Alert, USDC Treasury has just minted 50 million USDC on the Ethereum chain.

Disclaimer: As a blockchain information platform, Golden Finance publishes articles for information purposes only. For reference only, not as actual investment advice. Please establish the correct investment concept and be sure to improve risk awareness.

JinseFinance

JinseFinance

JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance Others

Others Bitcoinist

Bitcoinist Nulltx

Nulltx Cointelegraph

Cointelegraph