Author: Katherine Ross, David Canellis, Blockworks; Translator: Baishui, Golden Finance

Are you having fun?

It’s been a while since we last covered Pump.fun, or any of the celebrity memecoins.

As K33 analyst David Zimmerman puts it, the Solana-based dapp helps people “dig for gold in the memecoin space” by selling “shovels.”

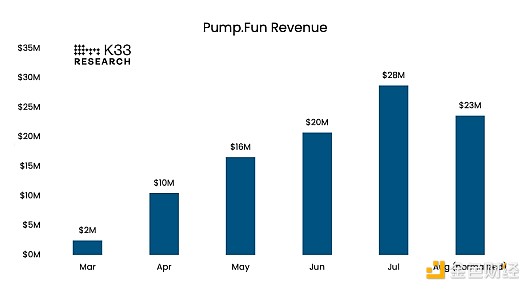

Pump’s revenue peaked in July but has fallen so far this month. To be fair, though, there’s still a week left in the month.

Source: K33

K33 analyst David Zimmerman wrote: "Pump's simple idea has attracted a large number of users, and the dapp has also seen rapid growth. The cumulative revenue since its launch has reached nearly $100 million, reaching the revenue figure that DeFi teams dream of."

"At the time of writing, Pump's 24-hour revenue was $520,000, followed by Solana's $356,000, Ethereum's $336,000 and Aave's $297 The platform was founded in January, but didn’t start to gain traction until March. Since then, revenues (both in absolute numbers and trajectory) are among the most impressive in DeFi history.”

How sustainable is Pump.fun?

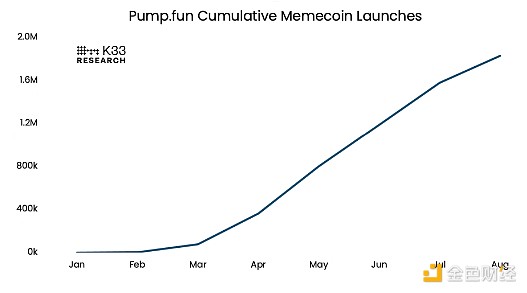

Well, this is where things get a little tricky. At first, “a rising tide lifts all boats,” but since then — with the pace of launches (shown below), the landscape has become a bit cannibalistic and competitive. Zimmerman believes this could make “traders completely unprofitable” — if it isn’t already.

Source: K33

Since January, 1,829,747 memecoins have been issued.

When the research report was published yesterday, As of this writing, 10,740 tokens have been issued. Of these tokens, only 136 have a market cap above the $69,000 required to enter DEX trading.

There are now too many top wallets (i.e. users with $100,000 to over $1 million in the profitable wallet tier ranking, which is a very small fraction of wallets) pumping and dumping their own deployed tokens.

“Pumps initially provided a great venue for traders looking to profit from trading newly minted memecoins. Due to the sheer volume of tokens being produced, it’s now impossible for users to do so unless they’re engaging in nefarious and manipulative on-chain activity,” Zimmerman said.

It’s also worth pointing out that others — like Justin Sun’s Tron — are trying to get a piece of the action by launching their own memecoin deployers. Just last week, Tron launched Sun.pump, which has already created over 26,000 tokens according to Dune data. But let’s not pretend the memecoin craziness is just Solana’s problem. Last month, L1 and L2 token issuance on Ethereum exceeded 403,000, just slightly higher than the 398,000 on Pump.

Zimmerman said it best: “The problems with the Pump reflect those of crypto as a whole — altcoin saturation, little innovation, and relatively little capital inflow. In terms of trading, given the surge in altcoins, there simply isn’t enough new capital inflow to create a wave that benefits all boats.”

“Increasingly fierce competition is forcing us to be more aggressive on profit taking and more flexible on rotation.”

Actually, here’s a meme that might really help you understand this situation:

Source: Looper

Ah, yes.

Not that it’s not fun to pass the buck, but let’s be clear, we’ve said it once and we’ll say it again: This cycle is different. The available liquidity is different. And that means cryptocurrencies have to evolve and change how they approach certain aspects of their ecosystems.

While the microcap memecoin market may have dried up, there’s still plenty of opportunity, Zimmerman writes.

— Katherine Ross

Dogecoin started the fire

Memecoins weren’t a flash in the pan.

Since Dogecoin launched in 2013, they have outlasted every cryptocurrency market cycle. That’s the equivalent of six bull and bear markets, and yet they remain as popular as ever.

Yes, there are hundreds, if not tens of thousands, of pumps and dumps every week. Some are successful, but the vast majority are not.

The cheaper networks, including BNB Chain, Solana, Base, and most recently Bitcoin via Ordinals, can be seen as a home for various tokens and memecoins that never succeeded, or, if they did, only succeeded for a short period of time.

There are a lot of memecoins that did succeed, even if that depends on your definition of success. There are currently 18 memecoins with a market cap of $250 million or more, with the lowest market cap being roughly the same as more serious projects like Arkham, Dymension, Manta, and 1inch.

Another 180 or so coins have a market cap of $5 million or more, which could be worth significantly less if a significant number of their tokens were sold at once.

Still, tracking the top 50 memecoins by market cap over the past seven years shows that they are indeed slowly eating up crypto. But they have recently hit a ceiling.

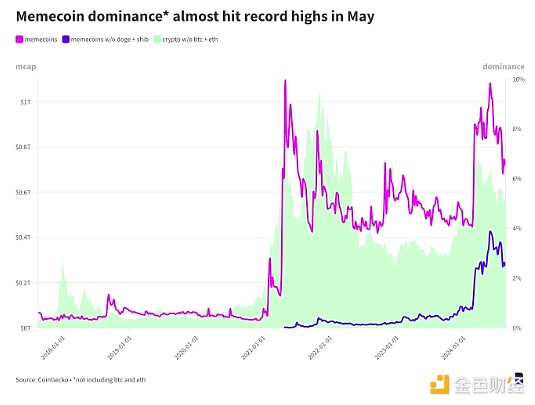

The chart below plots memecoin dominance versus total cryptocurrency market cap. It does not include all coins. But it does cover about 95% of the total memecoin market cap.

DOGE and SHIB currently account for 75% of the entire memecoin market, so it's worth separating the rest to spot any trends.

One thing to note: market dominance usually refers to how much of the market is made up of a particular asset - Bitcoin's current dominance is 57% because it contributes this amount to the total market capitalization of cryptocurrencies.

In this case, Bitcoin and Ethereum are removed from the calculation. Memecoins, including those that double as native tokens for their own independent networks, are rarely intended to compete with either cryptocurrency, so it’s more interesting to measure the relative dominance of memecoins versus the rest of the cryptocurrency market.

Meanwhile, the blue line follows the market dominance of memecoins that aren’t DOGE and SHIB.

Note that memecoin dominance has been trending upward since 2021. Elon Musk’s involvement in the cryptocurrency zeitgeist was at its peak at the time, and he was very fond of promoting DOGE.

Overall, memecoin dominance excluding Bitcoin and Ethereum is currently 6.5%. Without DOGE and SHIB, it’s closer to 2.65%.

Dominance peaked at nearly 10% in May 2021 and was just below that level at the end of May of this year.

Perhaps most tellingly, the blue line reached its all-time high around the same time and has been trending upwards ever since, even as the purple line retraced between November 2022 (the FTX crash) and February of this year.

This suggests that the newer memecoins, at least the ones that have survived, are indeed finding solid footing within the broader crypto market.

Crypto is many things, one of which is pure peer-to-peer financial anarchy. That’s what’s sparked the interest of many newcomers to the space.

If the core of crypto and blockchain — pseudonymity, untraceability, and censorship resistance — has been eroded by waves of regulation over the years, the memecoin market is holding the torch high.

— David Canellis

Impromptu Q&A

Q: Is the memecoin craze over?

One thing that comes out of the data is that memecoin dominance tends to correlate with the broader cryptocurrency market.

There’s usually a lag of a few months, but if crypto goes up, memecoin’s market share usually goes up too.

So if crypto takes a long breather from now on, the memecoin moment may be over (for now).

Obviously, memecoin launchpads will persist through market cycles, just like memecoin itself.

Defining this cycle with the advent of ETFs, the rebirth of prediction markets, and the popularity of memecoin launchpads wouldn’t be the worst thing for the space. At least those are bringing in serious revenue.

PS: Yesterday, I wrote that Franklin Templeton uses Ethereum for its money market fund. As a reader pointed out via email last night, it actually uses Stellar and Polygon. Thanks!

— David Canellis

I thought this was a play on time.

It’s fun and offers a ton of opportunities, no doubt, but it’s risky and now, as Zimmerman wrote in yesterday’s report, it’s increasingly difficult for traders to make a profit.

Does this mean that crypto can’t be fun anymore? Of course not. There will be other games or trends that allow people to have fun while making money, that’s the nature of some parts of crypto. If it weren’t for the memecoin craze, I’m sure it would return soon in another form.

But for now, (micro)memecoin games aren’t.

In some ways, that’s a good thing. Crypto is constantly evolving and we have to change with it. I can also understand that some people might not want to accept this change.

As for me, I’m always excited about what’s next. So let’s get to the next chapter.

—— Katherine Ross

Chris

Chris

Chris

Chris JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance Coinlive

Coinlive  Bitcoinist

Bitcoinist Cointelegraph

Cointelegraph Cointelegraph

Cointelegraph Ftftx

Ftftx