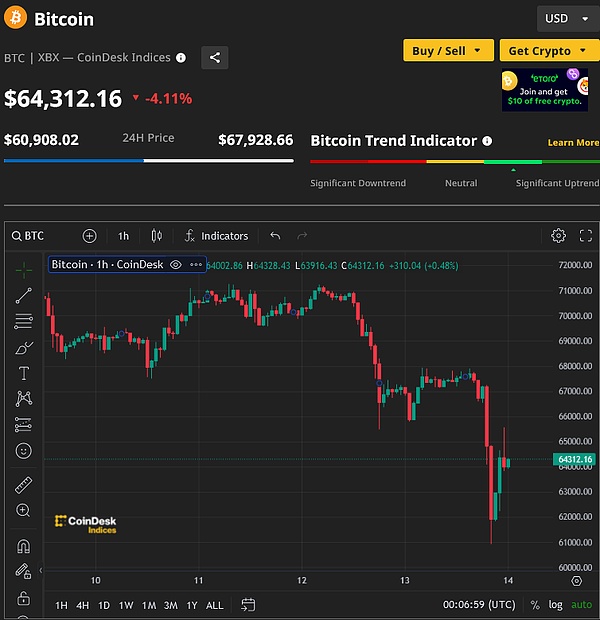

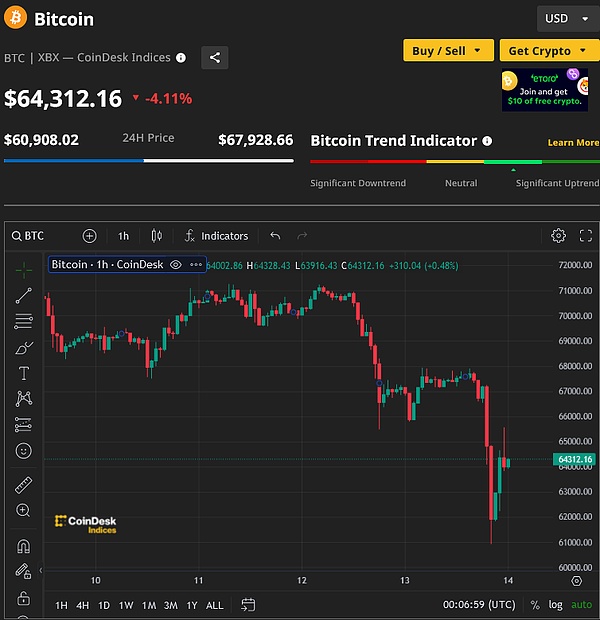

On April 13, the virtual currency market was in a bloodbath again. Among them, the price of Bitcoin once plunged by more than $6,000, from $67,100 to below $61,000. According to CoinGlass data, a total of 296,300 people in the virtual currency market were liquidated within 24 hours.

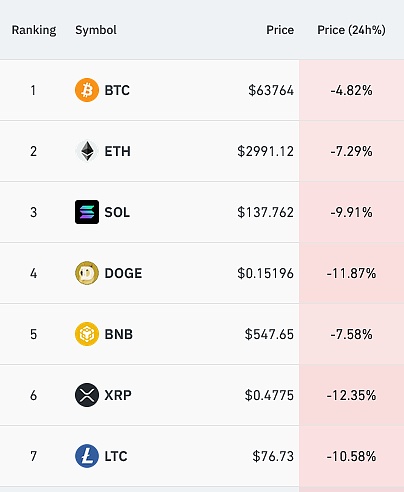

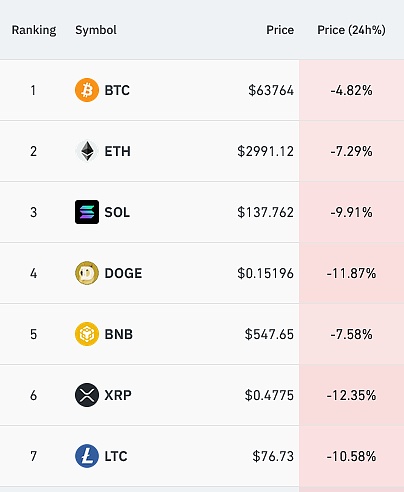

According to CoinGlass data, a total of 296,300 people in the virtual currency market were liquidated in the past 24 hours, with a total liquidation amount of $920 million. The price of Bitcoin has plunged by nearly $10,000 in the past two days, from $71,000 to below $65,000, and then to below $61,000. As of press time, Bitcoin was quoted at $64,312. In addition, the entire virtual currency sector of Ethereum, Dogecoin, and SOL coin fell sharply.

Reasons for the plunge

The current mainstream views mainly focus on three reasons:

1. One is the uncertainty of the Fed's interest rate cut. Mainstream institutions are confused. They had previously speculated about May, June, and July. Now they are not sure. The U.S. inflation is high and the Fed's hawkish remarks are----

2. Geopolitical reasons. Iran and Israel may have a zz outbreak at any time. Everyone is panicking.

3. In the next two or three months, there may be a risk of large-scale sales of Bitcoin miners.

If I were to tell you the reason, it is just that some behind-the-scenes capital dealers are harvesting. The crypto market has been rising for about half a year, and it is time to clean it up. No financial market can rise all the time, and of course it will not fall all the time. It is normal to rise and fall. Everyone, please pay attention to the risks!

The global market went crazy yesterday

Not only the crypto market, but the entire global financial market went crazy last night. The epic rise in gold prices started to fall around 23:00 Beijing time, and once fell by nearly $100 from the high point. This should be the largest intraday drop in history.

At the same time, both U.S. crude oil and Brent crude oil fell, falling by $2 from their highs.

U.S. stocks fell across the board, with declines of more than 1%. The Dow fell 1.24%, the S&P 500 fell 1.46%, and the Nasdaq fell 1.62%. At the same time, Wall Street's "fear index" - VIX - soared to October levels.

First, a report in the Wall Street Journal that "Iran may attack Israel in the next two days" made the global market feel like it was facing a great enemy. It also triggered a safe-haven scramble across the market on Friday, prompting traders to sell stocks and buy gold and dollars instead.

But in the evening, everything entered a falling mode: the price of gold fell nearly $100 from the high point of the day, which should be the largest intraday drop in history; oil prices also fell by more than 1%; US stocks fell across the board, and the decline was more than 1%; Bitcoin lost a week's gain overnight.

Within one day, the market atmosphere was twice raised to the level of "collapse". First, "gold, crude oil, and the US dollar" soared on the same day, reflecting the significant impact of the crisis on the market. Then "gold, crude oil, and US stocks" plummeted (note that the combination of the three markets before and after is different), which made people feel that it was the beginning of a plunge.

Since the Federal Reserve started the interest rate hike cycle in March 2022, it has been working hard to suppress market volatility. Now, as people lose the consensus of "expectation of interest rate cuts", the market has also gone out of control.

First, next Monday will never be calm. Like a ball falling from a high altitude, it will not stop on the ground immediately, but will bounce up and cause secondary disasters. If Iran launches an attack on Israel during the weekend, we will see a scene rarely seen in decades on Monday.

Second, panic in the US stock market has returned, and the Chicago Board Options Exchange Volatility Index (commonly known as Vix) broke through 17 on Friday, closing at its highest level since October last year - indicating that investors are betting on rising turbulence. In addition, according to Bank of America data, US large-cap stocks just recorded the largest weekly outflow of funds since December 2022 in the week ending Wednesday.

Third, the US dollar index has risen to its high this year and closed at its lowest point of the day on Friday, with no signs of stopping. If the US dollar continues to rise, it will be a disaster for the whole world.

The financial market is like a wild horse that can run away and rush to anywhere. 1. No one knows why gold prices have plummeted, just as no one can explain why they have soared. The only thing that is certain is that global market volatility will increase significantly, because the market has lost consensus on the timing of the Fed's first rate cut. Wall Street has given various answers, including June, July, September, December, or no rate cut this year. "When will the Fed cut interest rates?" is like a beacon on the road for the market, and when the light goes out, investors lose their direction. This is like a customer shopping in a mall, and the light suddenly goes out when he is buying something. Panic will surely follow, and people will subconsciously want to escape, but they can't find the exit, which can easily cause a stampede - this is what is happening in the financial market now. 2. The decline of US stocks is different from the past. In the past, the Fed could hint at an upcoming policy easing, but now the Fed has nothing in its hands. This week, several senior Fed officials delivered speeches, and they maintained unprecedented unity, "not in a hurry to cut interest rates, and it is not time to cut interest rates yet." Now the Fed does not know when to cut interest rates, and they are waiting for guidance from economic data. The current crisis may last at least until April 29.

3. Geopolitical risks make this crisis complicated. What the financial market knows is that Iran can and will attack Israel at any time. Investors are always in a state of being on high alert. They cannot cope with the sudden change in the Fed's interest rate cut expectations and the risk of war that may break out at any time. It's like a shopping mall with a power outage and an earthquake. It's difficult for people inside to escape. What we need to do now is no longer to study what just happened, but to find a place to hide.

This is a profound revolution in the global market.

JinseFinance

JinseFinance